Frequently Asked Questions (FAQ) of Payment Systems on Exness Part 2

How do I verify my payment method?

For Bitcoin and transactions using a bank card, you will need to provide both Proof of Identity (POI) and Proof of Residence (POR), but for almost every other payment method address verification is not necessary at first.You will need to fully verify your Personal Area if you wish to continue trading.

To fully verify your Personal Area, log in, and click Complete Verification at the top of the main area. Follow the on-screen prompts to complete your economic profile and upload your POI and POR documents; once verified, you will be able to transact with any available payment methods (although regional limits still apply).

Do I need to deposit real money when trading on a demo account?

The answer is No.When you register with Exness through the web, you will automatically be given a demo MT5 account with USD 10,000 virtual funds which you can use to practice your hand at trading. Furthermore, you can create additional demo accounts which have a preset balance of USD 500 which can be changed during account creation and even afterwards.

Registering your account on the Exness Trader app will also give you a demo account with a balance of USD 10,000 ready to use. You can add or deduct this balance using the Deposit or Withdrawal buttons respectively.

How can I cancel my deposit/withdrawal request?

Once you have initiated a deposit or withdrawal request by clicking Confirm Deposit or Confirm Withdrawal, your transaction will appear in the Recent Operations section of the Deposit and Withdrawal areas of your Personal Area.Recent Operations

If you are able to see a Cancel button under the Status column for the transaction, then you can click on this to cancel the deposit or withdrawal.

If the option is unavailable, it means the transaction is already being processed and cannot be cancelled.

If you need assistance, do not hesitate to contact our friendly Support Team.

What is 3D Secure?

3D Secure (3-domain secure) is an additional security layer for online debit/credit card transactions. It has been put in place to prevent any fraud in such transactions from happening. Exness allows the use of only 3D Secure credit/debit cards to make deposits and withdrawals with Exness. This means after you enter your card details, there will be an additional step where you will need to enter the OTP (One-Time Pin/Password) sent to your phone, to complete the transaction.Note: Mostly 3D Secure is indicated on bank cards. If you are unsure if your card is 3D secure or not, please contact your card issuing bank.

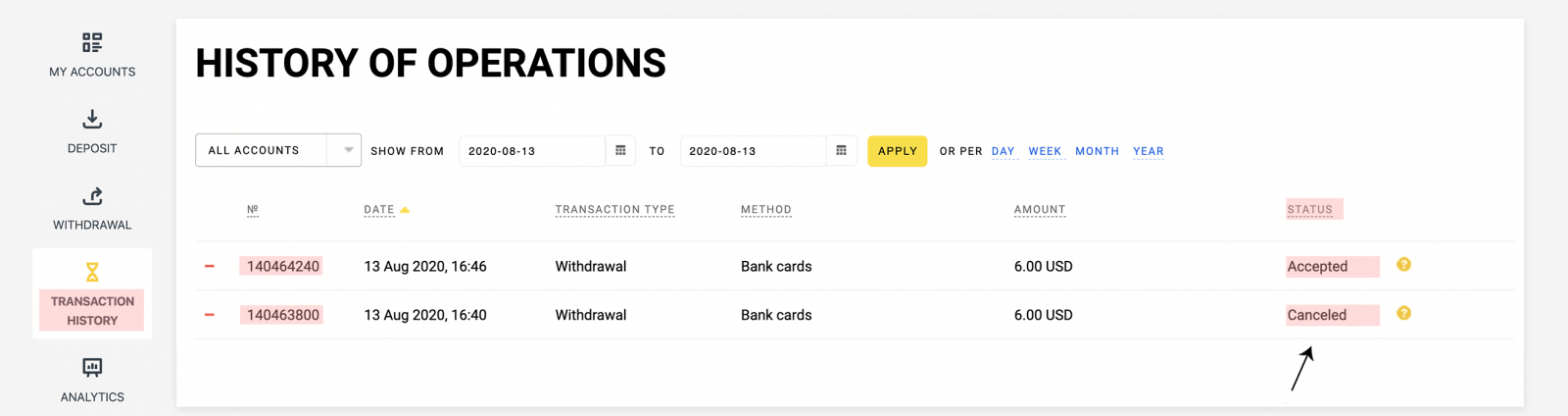

Where can I check the status of my deposit, withdrawal or internal transfer transactions?

A record of all transactions, including deposits, withdrawals, and internal transfers are available from your Personal Area.

- Log in to your Personal Area.

- Click Transaction History to be taken to an exhaustive list of completed and pending transactions.

- Identify the transaction by its numbered ID code, then look under that item’s status.

- Under Status, you will see the transaction’s status: Done, Pending, Rejected, etc.

Done means the transaction was completed.

Pending means, the transaction is yet to be completed.

Rejected means that the transaction was cancelled, the reason for which varies.

The results can also be filtered in other ways, including by trading account and timeframe; remember to click Apply when your preferences are set.

Please note that pending transactions cannot be manually canceled; if the need to cancel the transaction presents itself, please contact customer support in a timely manner for the best chance to have it resolved. It is advised to have your account details and secret word handy to verify yourself.

Can I still withdraw If I have open positions?

Yes, you can.Free margin shown in your Personal Area is a ‘floating’ amount (constantly changing) of funds which can be withdrawn at any given moment. However it’s not encouraged to withdraw with open positions, as there is a possibility that your Free Margin drops enough to impact open positions, unintentionally closing them due to Stop Out.

We recommend further reading about how to calculate margins; then you’re better able to plan your withdrawals so they don’t unintentionally impact your Free Margin.

What is the fastest way to deposit and withdraw funds?

Processing times for deposits and withdrawals depend entirely on the payment method chosen. We offer a number of payment service options, some that change based on geographical location (automatically detected based on your account details).Because these options can vary widely, it is impossible to recommend any single one as the fastest way to deposit or withdraw funds however here are some things to consider:Generally speaking, choosing deposit and withdrawal methods described at ‘instant’ will be on average faster than other methods.

- The method used for depositing must also be used proportionally to withdraw as well. Therefore try to choose a payment method with both quick withdrawal and deposit processing speeds; key to quicker transactions.

- Most payment services offer ‘instant’ withdrawal, but this is understood specifically to mean: a transaction is carried out within a few seconds without manual processing by financial department specialists.

This does not guarantee that a withdrawal will complete instantaneously, but that the process is begun instantly.

- Deposits and withdrawals may be made 24 hours a day, 7 days a week. If a deposit or withdrawal is not carried out instantly, it will be completed within 24 hours.

- Exness is not liable for delays in processing deposits and withdrawals if such delays are caused by the payment system.

What is the minimum amount needed to start trading?

This depends on your account type, with a wide-range of options for any trader offered.For Standard Accounts, the minimum deposit is USD 1 and you can start trading right away. For Professional Accounts, the minimum deposit is USD 200.

If you would like to give trading a try, Exness does offer Demo accounts. These don’t require real money to trade and are helpful as a trading practice. Open up a Demo Account and start practicing today.Please note: regional differences can apply to minimum deposits for certain Pro accounts, so it is always advised to confirm your minimum deposit based on your region as well.

Can I deposit using a friend’s payment system?

At Exness, we prohibit third party deposits and therefore you can only use payment systems registered under your own name to fund your account(s). We do this to ensure that there are no conflicts during fund withdrawals because funds can only be withdrawn to the payment systems they were deposited from.If your preferred payment system is blocked or not available due to some reasons, please contact our Exness Support Team for assistance.

Can I make a deposit if my current balance is negative?

Yes, you absolutely can. However, we suggest waiting if you see a negative balance on any of your accounts, as it will be automatically corrected by a NULL operation; a NULL operation adjusts an account with a negative amount to a balance of zero.Exness offers negative balance protection as we perform a NULL operation on all accounts that have negative balance.

If you deposit funds into a negative balance, you will only receive a part of your deposit after the negative balance deduction and will need to contact the Exness Support team In order to recover that amount.

How do I top up a Demo account?

Topping up your Demo account is a simple process and can be done in multiple places.For desktop users

Simply follow these steps:

- Log in to your Exness Personal Area.

- Navigate to the Deposit tab.

- Choose Demo account replenishment under Other methods.

- Select the Demo account, the amount, and currency, then click Make Deposit.

- A message will appear telling you of a successful deposit.

Alternatively

- Log in to your Exness Personal Area.

- Find the Demo account you would like to top up.

- Click Set Balance, then enter the amount you would like your Demo account to reflect.

- Complete the action by clicking Set Balance again.

- This will set your exact balance to your needs successfully.

For Exness Trader users:

- Log in to the Exness Trader app.

- Tap the dropdown, setting it to Demo Accounts.

- Navigate any accounts by swiping until you’ve found the Demo account you want to top up.

- Tap Deposit, enter an amount, and click Continue.

- A message will confirm the action has been completed.

What if my preferred payment system is missing in my Personal Area?

When a payment system is not presented in the Deposit or Withdrawal sections of your Personal Area, it means that it is currently under maintenance and has been temporarily removed.We do offer numerous options for payment services, but we recognise that your chosen payment system is preferable - in the case of depositing we recommend waiting for this payment system to return or, if urgent, consider using another available payment system.

In the case of a withdrawal, we advise waiting for the payment system to return or, if urgent, you can send an email with information that will help us detail your requirements, including:

- Account number

- The name of the payment system you require

- Your secret word for account verification

We thank you for your patience and understanding during these periods of maintenance which can be caused by anything from the payment service providers to the banking systems themselves.

Can I withdraw using a different payment method?

Unfortunately, this is not possible.One of the basic rules of using payments at Exness is using the same payment method for both deposit and withdrawal. This is done to ensure that funds are withdrawn to the legitimate account holder.

Can I use more than one bank card to fund my account?

Yes, there is no limit to how many bank cards you can save to your Personal Area.However please be aware that when depositing with one payment method, withdrawals need to use the exact same method - this is to prevent others from withdrawing from an account fraudulently.

Please be aware of this important rule when making transactions;Therefore if you use one bank card to deposit, you will not be able to withdraw those funds with a different bank card.