How to Sign in and Withdraw Money from Exness

This guide will walk you through the steps to sign in to your Exness account and withdraw money, making the process straightforward and efficient.

How to Sign in to Exness

Sign in to Exness

1. Exness’s login page can be accessed on any web browser that is connected to the internet. Click on the “Sign in” button.

2. This will open the Exness login page, enter your email address and password that is registered to log into your account, and click "Continue".

3. After logging into your Personal Area successfully. From My Accounts, click the account’s settings icon to bring up its options.

4. Select Account information and a pop-up with that account’s information will show up. Here you will find the MT4/MT5 login number and your server number.

Note that in order to log in to your trading terminal you need your trading password as well which is not displayed in the Personal Area. If you have forgotten your password, you may reset it by clicking Change trading password under settings as seen earlier. Login information like MT4/MT5 login or server number is fixed and cannot be changed.

If you want to trade right on your browser. Click "Trade" -- "Exness Terminal".

Exness Terminal.

Sign in to MT4

It is pretty simple to log into MT4, you just have your forex account number, password, and server details ready.

If you want to trade right on your browser, click "Trade" -- "MT4 WebTerminal".

You will see the new page below. It shows your Login and Server, you just enter your password and click "Ok".

That’s it, logged in successfully to MT4.

Sign in to MT5

Logging into MT5 is easy too. If you want to trade right on your browser, click "Trade" -- "MT5 WebTerminal".

You will see the new page below. It shows your Login and Server, you just enter your password and click "Ok".

Now you can trade on MT5.

How to Recover Exness password

The steps needed depends on which type of password you want to recover:

- Personal Area Password

- Trading Password

- Read-Only Access

- Phone Password (Secret Word)

Personal Area Password:

This is the password used to log into your Personal Area.

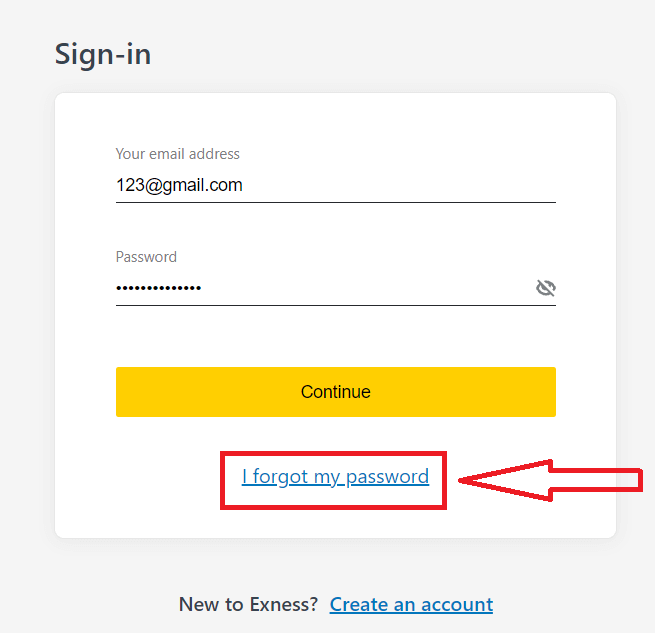

1. Go to Exness and click "Sign in", The new form will appear.

2. Select "I forgot my password".

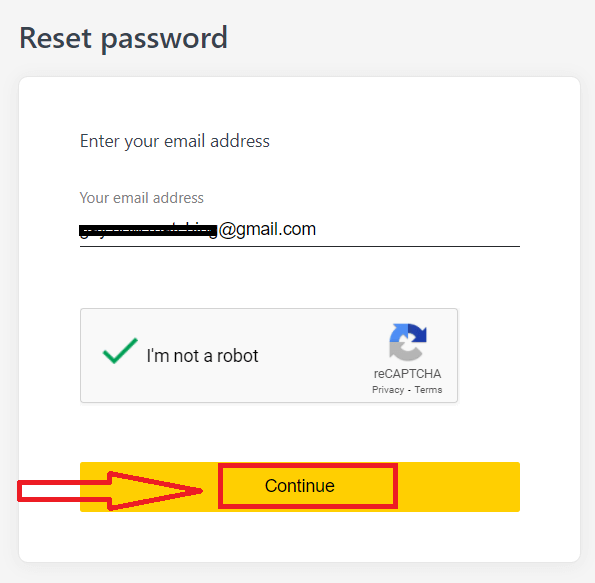

3. Enter the email address used to register with Exness, tick I’m not a robot, and click Continue.

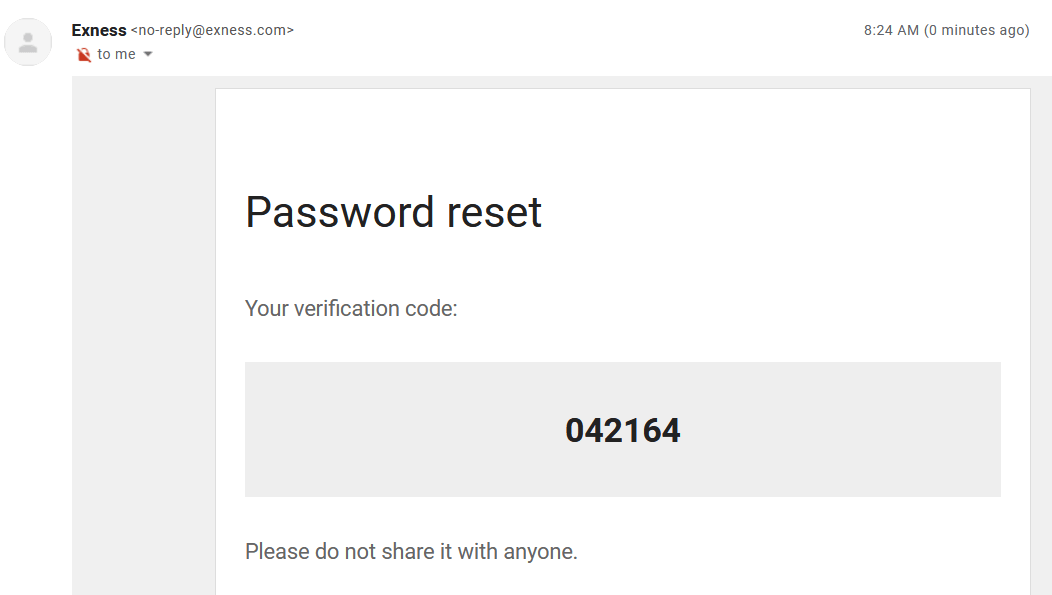

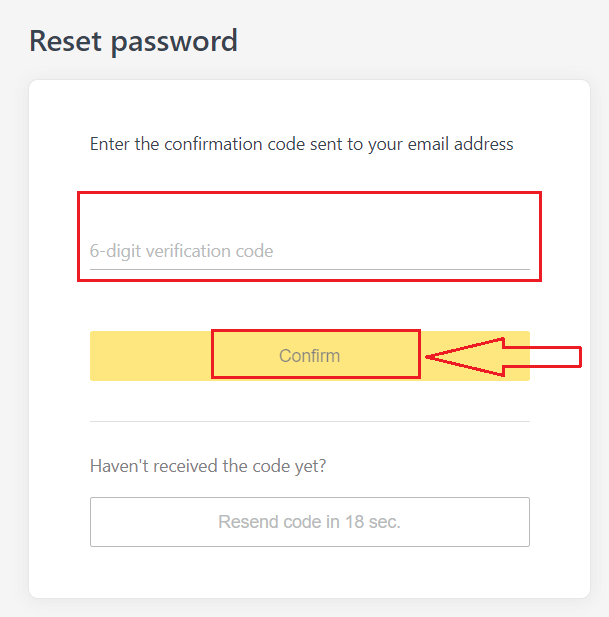

4. Depending on your security type, you will be sent a verification code to your email to enter in this next step. Click Confirm.

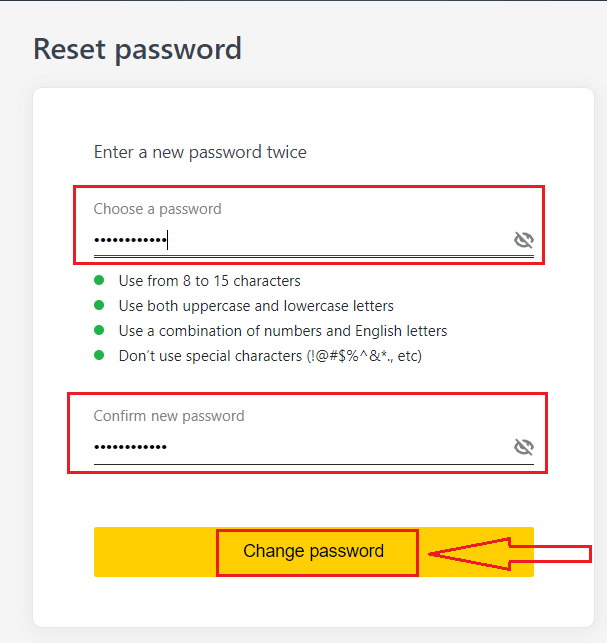

5. Enter a new password twice

6. Your new password is now set; you only need to use it when logging in to finish.

Trading Password:

This is the password used to log into a terminal with a specific trading account.

1. Log in to your Personal Area, and click the cog icon (dropdown menu) on any trading account in My Accounts, then select Change Trading Password.

2. Enter the new password, following the rules detailed beneath the pop-up window, then click Change Password.

3. Depending on your security type, you will be sent a 6-digit verification code to enter in this next step, though this will not be necessary for a Demo account. Click Confirm once done.

4. You will receive notification that this password has been successfully changed.

Read-Only Access:

This password allows limited access to a trading account to a third party, with all trading disabled.

1. Log in to your Personal Area, and click the cog icon (dropdown menu) on any trading account in My Accounts, then select Set read-only access.

2. Set a password, following the rules detailed, and ensure it is not the same as your trading password or it will fail. Click Confirm when complete

3. A summary including the server, login, and read-only access password will be displayed. You can click Copy credentials to save these to your clipboard.

4. Your read-only access password has now been changed.

Phone Password (Secret Word):

This is your secret word, used to verify your identity on our Support channels; via Live Chat or telephonically.

Your secret word, set when you first registered, cannot be changed so keep it safe. This is to protect our clients from identity fraud; if you have lost your secret word, contact Support via Live Chat for further assistance.

I’ve entered my 6-digit verification code incorrectly too many times, and I’m locked out now.

Not to worry, you will be temporarily locked out but you may try to complete this action again in 24 hours. If you would like to try again sooner, clearing your cache and cookies may help but do note this is not guaranteed to work.

Can’t sign in to Exness Personal Area

Facing difficulty while logging in to your Personal Area (PA) can be frustrating. Don’t worry, we have put together a checklist to help you.Username check

The username to log in to the PA is your full registered email address. Do not enter any trading account number or your name as the username.

Password check

You need to use the PA password set at the time of registration to successfully log in.

While entering the password:

- Check for any additional spaces that may have been added unintentionally. This usually happens when using copy-paste to enter information. Try to enter it manually if facing issues.

- Check if Caps Lock is turned on. Passwords are case sensitive.

Account check

If you have applied for your account to be terminated with Exness in the past, you cannot use that PA anymore. Moreover, you cannot use that email address to register again. Create a new PA with a different email address to register with us again.

We hope you find this helpful. In case of any further issues, do not hesitate to contact our friendly Support Team.

How to Withdraw Money from Exness

Withdrawal rules

Withdrawals can be made any day, any time giving you round-the-clock access to your funds. You can withdraw funds from your account in the Withdrawal section of your Personal Area. You may check the status of the transfer under Transaction History at any time.

However, be aware of these general rules for withdrawing funds:

- The amount you can withdraw at any time is equal to your trading account’s free margin shown in your Personal Area.

- A withdrawal must be made using the same payment system, same account, and same currency used as for the deposit. If you have used a number of different payment methods to deposit funds into your account, withdrawals are to be made to those payment systems in the same proportion as the deposits were made. In exceptional cases this rule may be waived, pending account verification and under strict advice of our payment specialists.

- Before any profit can be withdrawn from a trading account, the full amount that was deposited into that trading account using your bank card or Bitcoin must be completely withdrawn in an operation known as a refund request.

- Withdrawals must follow the payment system priority; withdraw funds in this order (bank card refund request first, followed by bitcoin refund request, bank card profit withdrawals, then anything else) to optimize transaction times. See more about this system at the end of this article.

These general rules are very important, so we’ve included an example to help you understand how they all work together:

You’ve deposited USD 1 000 total into your account, with USD 700 with a bank card and USD 300 with Neteller. As such, youll only be allowed to withdraw 70% of the total withdrawal amount with your bank card and 30% through Neteller.

Let’s assume that you’ve earned USD 500 and wish to withdraw everything, including profit:

- Your trading account has a free margin of USD 1 500, making up the total of your initial deposit and subsequent profit.

- You will first need to make your refund requests, following the payment system priority; i.e. USD 700 (70%) refunded to your bank card first.

- Only after all refund requests are complete can you withdraw profit made to your bank card following the same proportions; USD 350 profit (70%) to your bank card.

- The purpose of the payment priority system is to ensure that Exness follows financial regulations forbidding money laundering and potential fraud, making it an essential rule without exception.

How to Withdraw Money

At Exness, we aim to offer quick withdrawals and numerous payment systems to choose from. Our advantage is that you can withdraw funds at any time on any day, including weekends and public holidays.

Wire Transfers

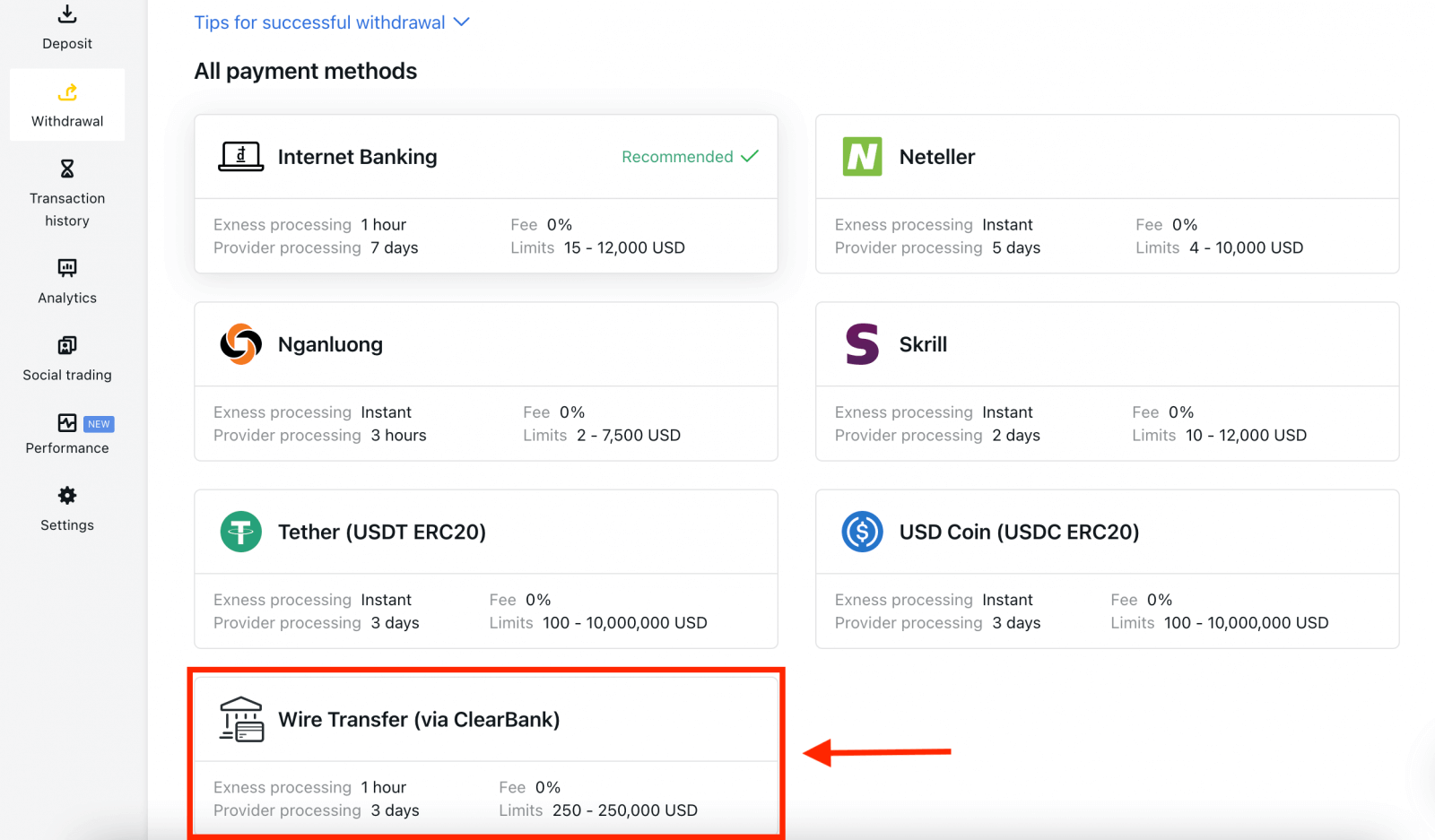

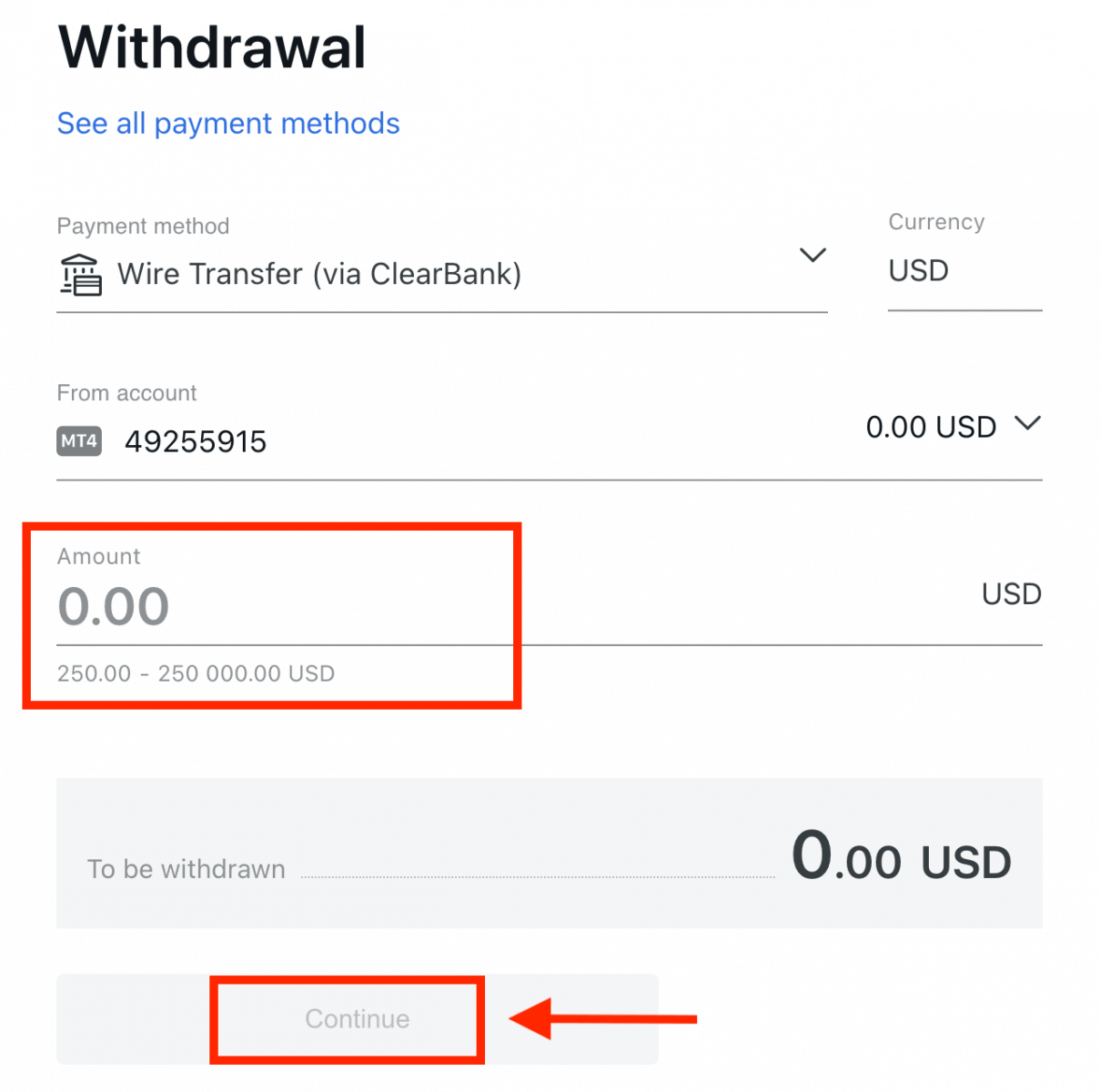

1. Go to the Withdrawal section of your Personal Area and select Wire Transfer (via ClearBank).

2. Choose the trading account you would like to withdraw funds from, choose your withdrawal currency and the withdrawal amount. Click Continue.

3. A summary of the transaction will be shown. Enter the verification code sent to you either by email or SMS depending on your Personal Area security type. Click Confirm.

4. Complete the presented form, including bank account details and the beneficiary’s personal details; please ensure every field is filled in, then click Confirm.

5. A final screen will confirm that the withdrawal action is complete and the funds will reflect in your bank account once processed.

Electronic Payment Systems (EPS)

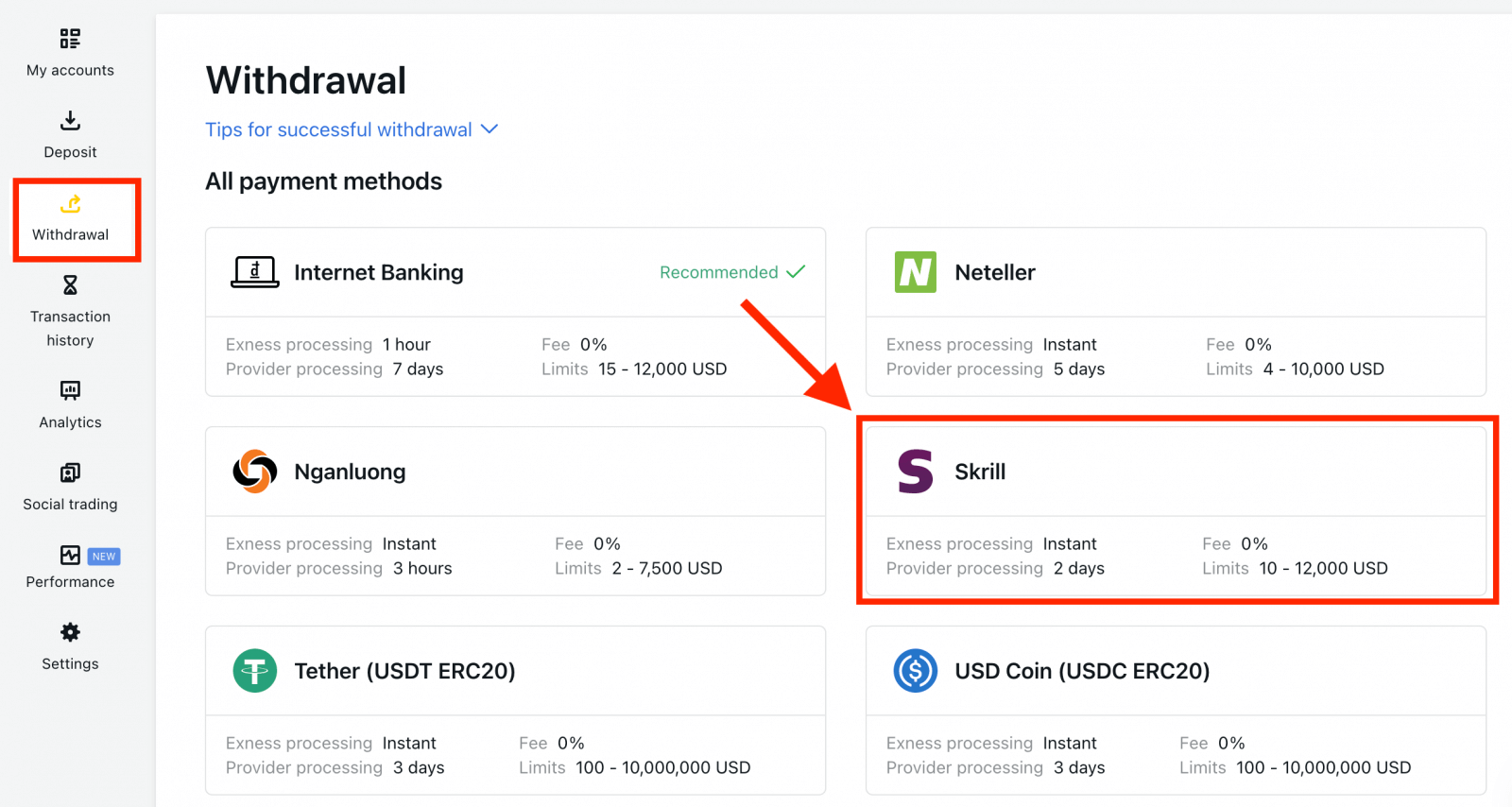

The vast majority of withdrawals by Electronic Payment Systems (EPS) are performed instantly, understood to mean that the transaction is reviewed within a few seconds (up to a maximum of 24 hours) without manual processing.1. Select the payment you wish to use from the Withdrawal section of your Personal Area, such as Skrill.

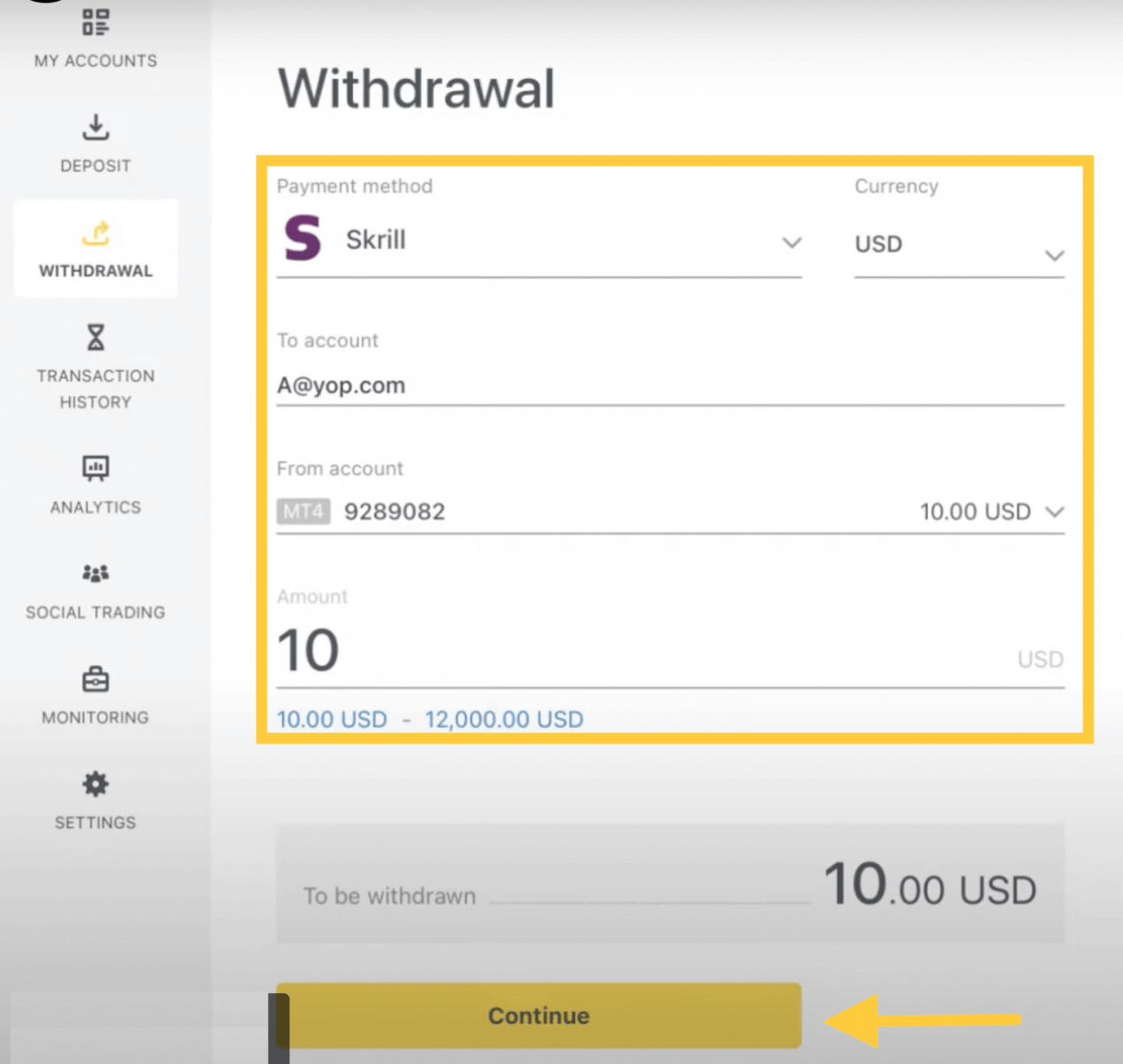

2. Select the trading account you would like to withdraw funds from, and enter your Skrill account email; specify the withdrawal amount in your trading account currency. Click Continue.

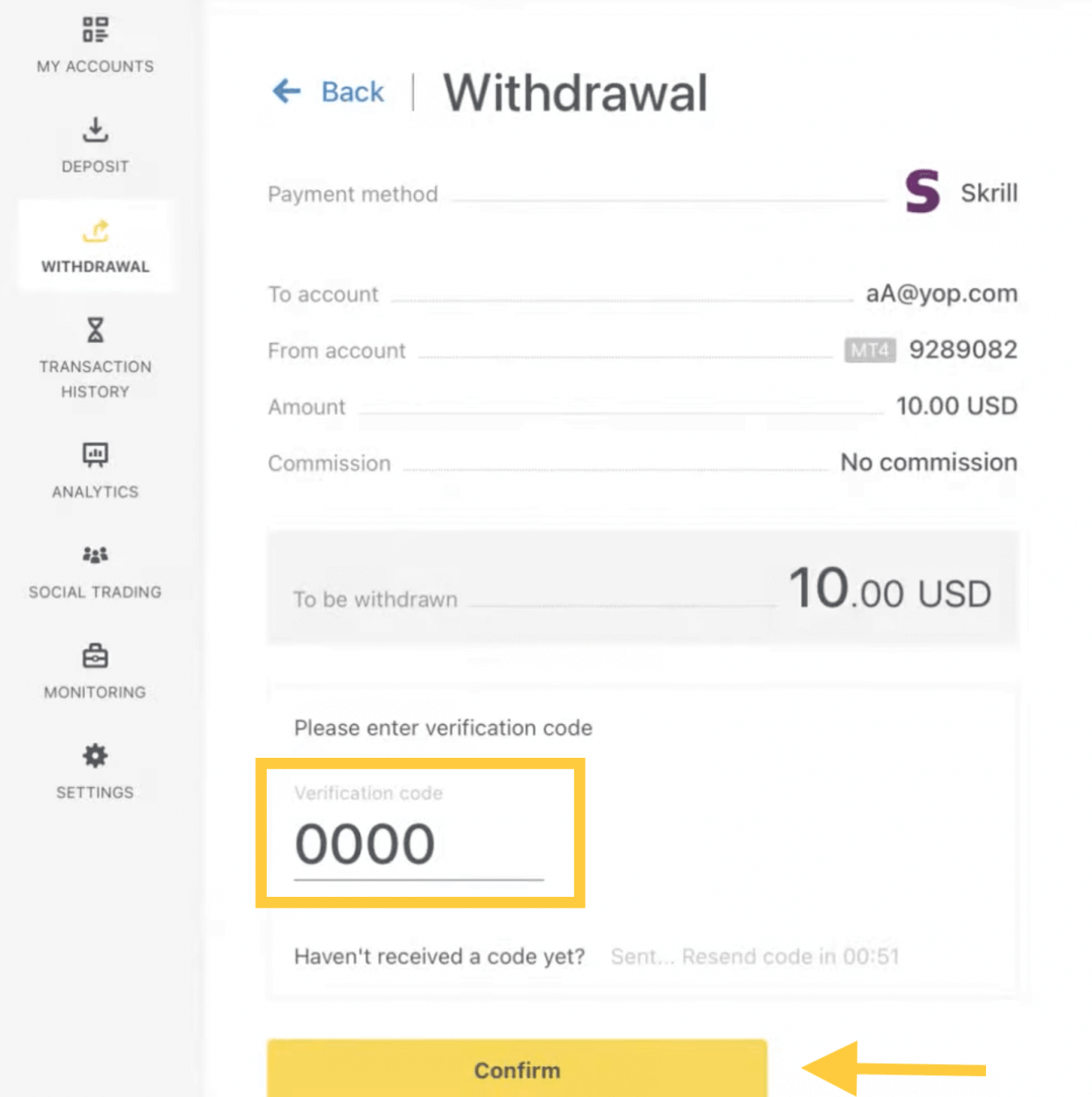

3. A summary of the transaction will be shown. Enter the verification code sent to you either by email or SMS depending on your Personal Area security type. Click Confirm.

4. Congratulations, your withdrawal will now begin processing.

Note: If your Skrill account is blocked, please contact us via chat or email us at [email protected] with proof that the account has been blocked indefinitely. Our finance department will find a solution for you.

Bank Cards

Please note that the following bank cards are accepted:

- VISA and VISA Electron

- Mastercard

- Maestro Master

- JCB (Japan Credit Bureau)*

*The JCB card is the only bank card accepted in Japan; other bank cards cannot be used.

Important: Bank cards are not available to accounts registered within the Thailand region.

*Minimum withdrawal for refunds is USD 0 for web and mobile platforms, and USD 10 for the Social Trading app.

**Minimum withdrawal for profit withdrawals is USD 3 for web and mobile platforms, and USD 6 for the Social Trading app. Social Trading is unavailable for clients registered with our Kenyan entity.

***The maximum profit withdrawal is USD 10 000 per transaction.

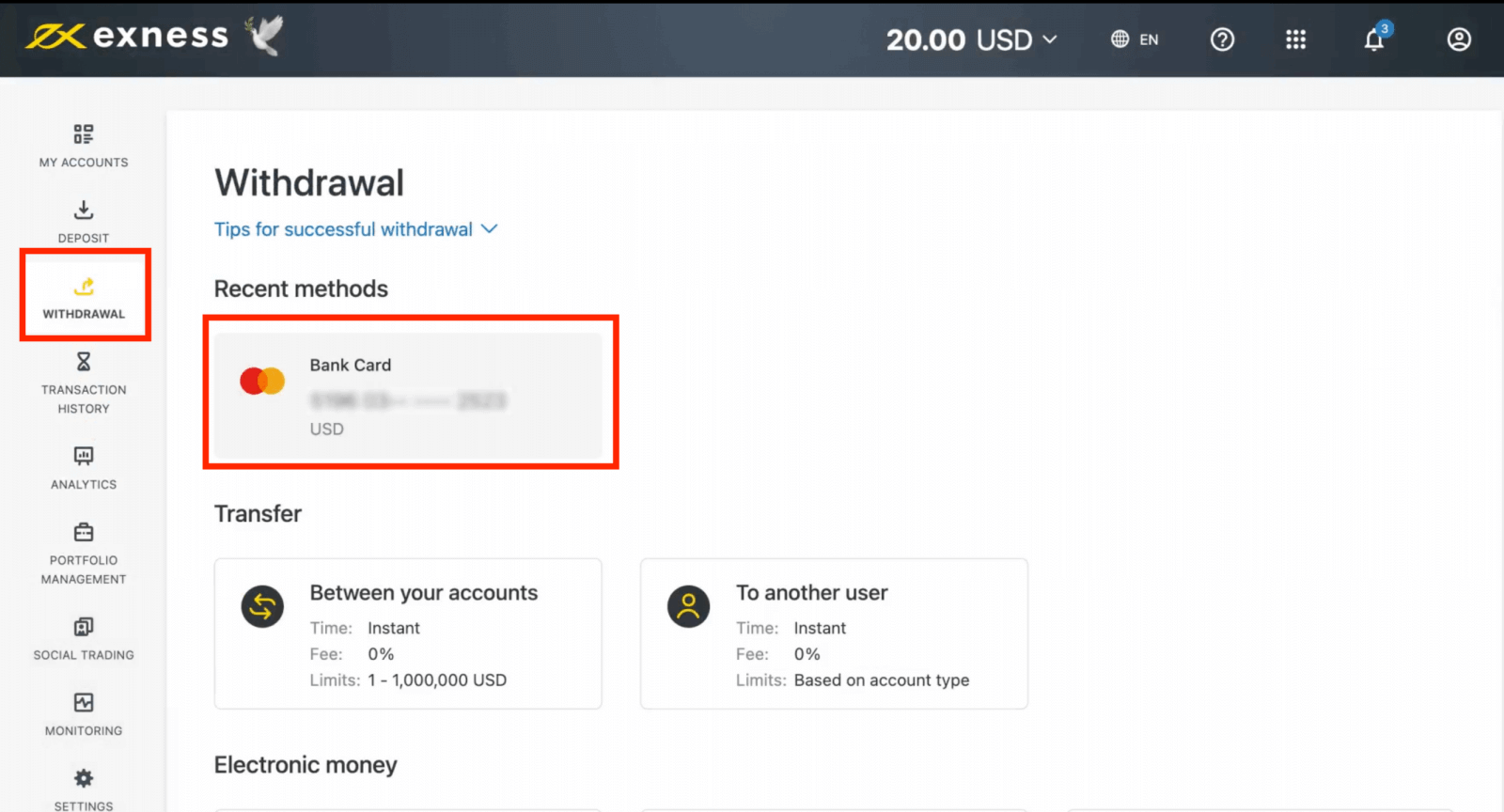

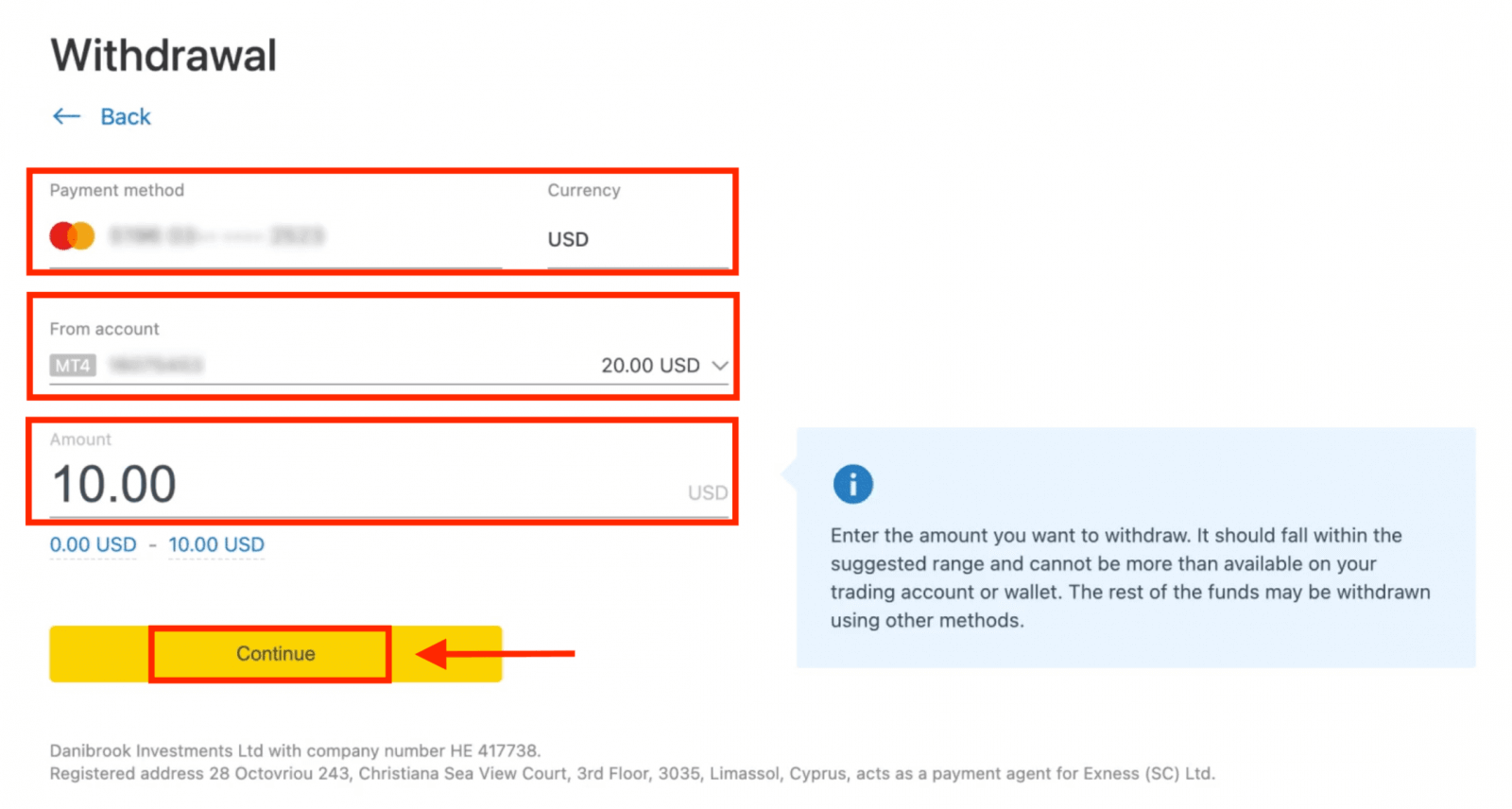

1. Select Bank Card in the Withdrawal area of your Personal Area.

2. Complete the form, including:

b. Choose the trading account to withdraw from.

c. Enter the amount to withdraw in your account currency.

Click Continue.

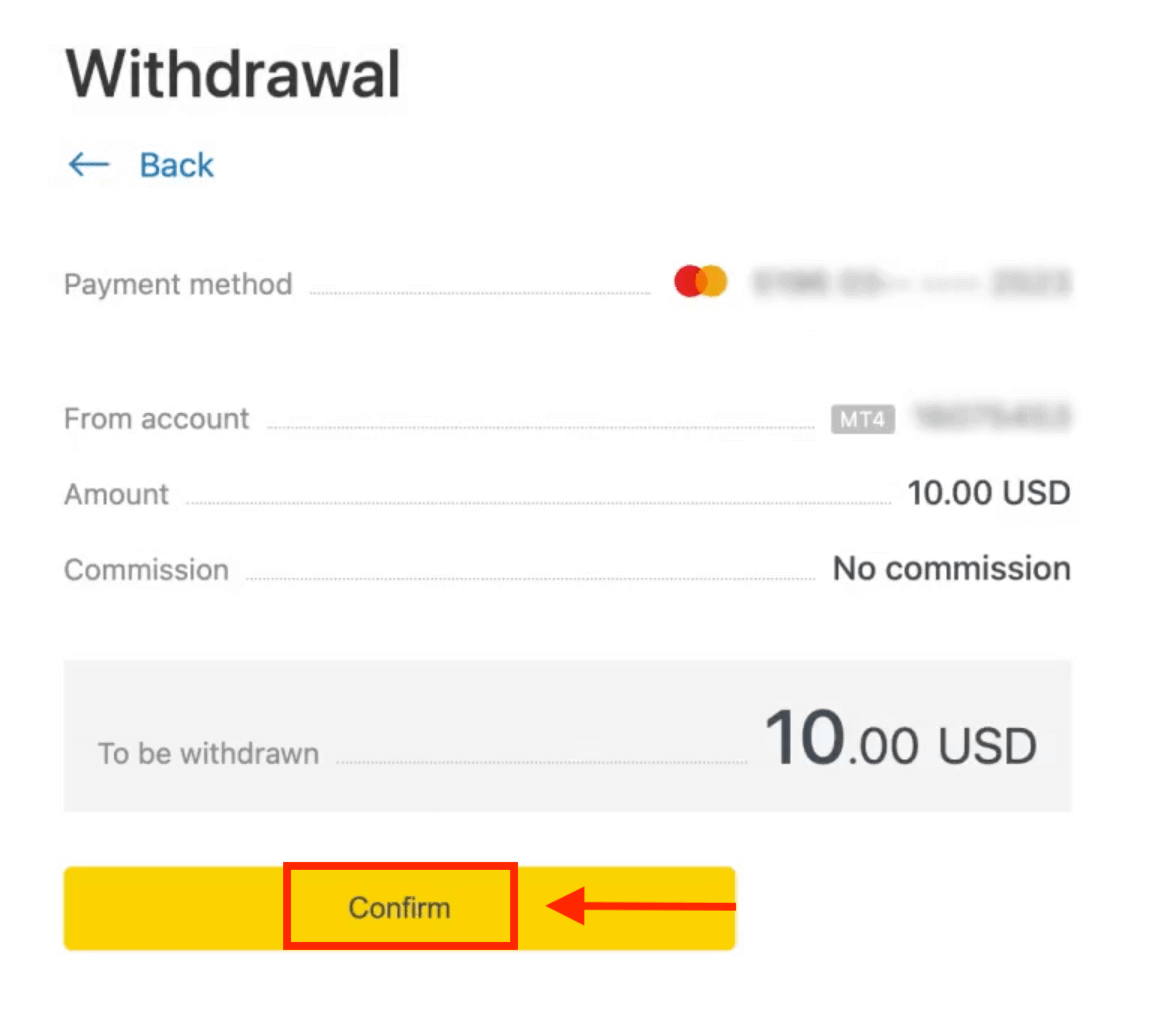

3. A transaction summary will be presented; click Confirm to continue.

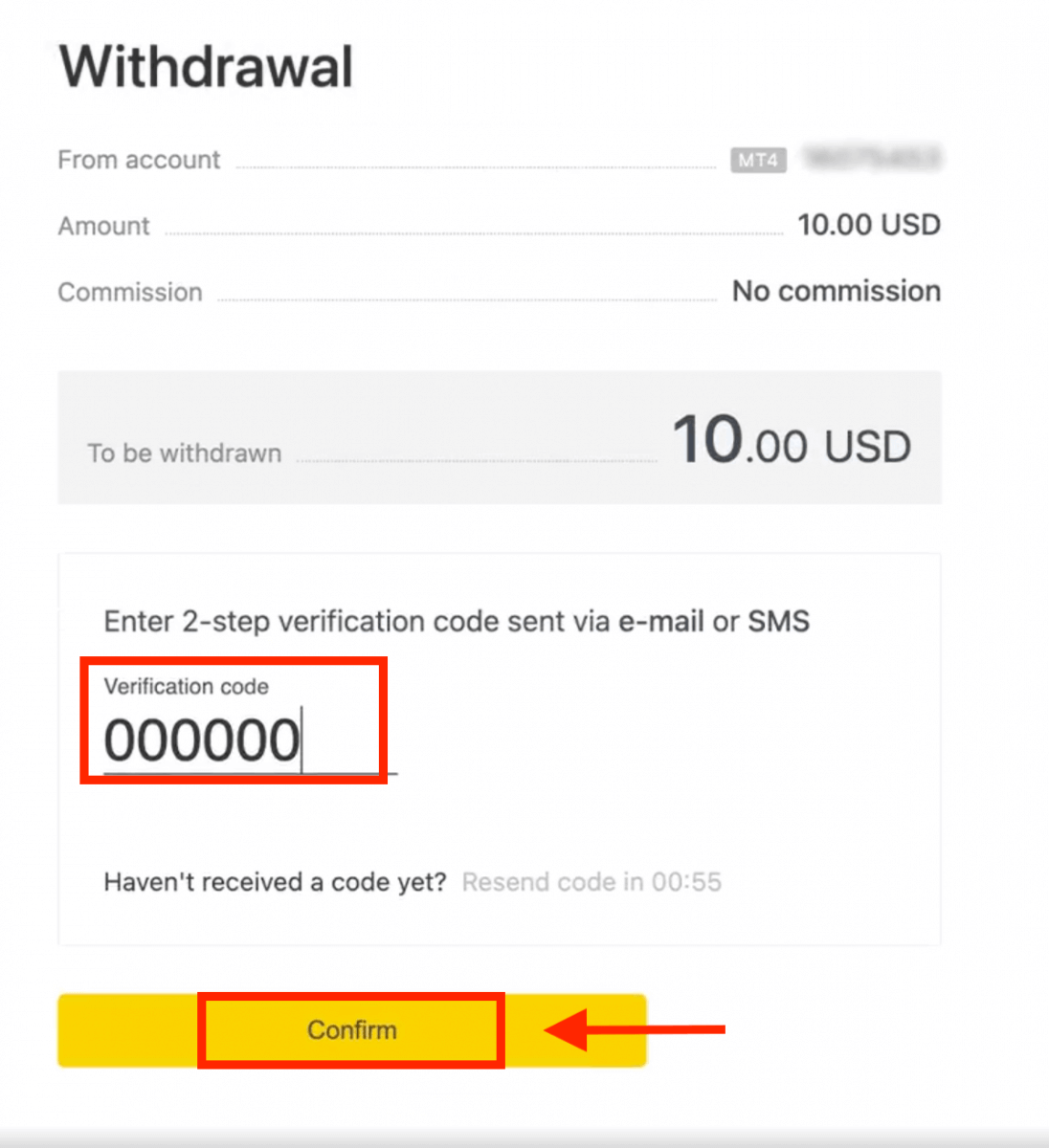

4. Enter the verification code sent to you either by email or SMS (depending on your Personal Area security type), then click Confirm.

5. A message will confirm the request is complete.

If your bank card has expired

When your bank card has expired and the bank has issued a new card linked to the same bank account, the refund process is straightforward. You may submit your refund request in the usual way:

- Go to Withdrawal in your Personal Area and select Bank card.

- Select the transaction related to the expired bank card.

- Proceed with the withdrawal process.

However, if your expired card isn’t linked to a bank account because your account has been closed, you should contact the Support Team and provide proof regarding this. We will then inform you what you should do to request a refund on another available Electronic Payment System.

If your bank card has been lost or stolen

In the event that your card has been lost or stolen, and can no longer be used for withdrawals, please contact the Support Team with proof regarding the circumstances of your lost/stolen card. We can then assist you with your withdrawal if the necessary account verification has been satisfactorily completed.

Bank Transfers

Withdrawal of your Exness trading accounts is made convenient with bank transfers, with no commission fees on transactions with this payment method.

1. Choose Bank Transfer in the Withdrawal section of your Personal Area.

2. Select the trading account you would like to withdraw funds from and specify the withdrawal amount in your account currency. Click Continue.

3. A summary of the transaction will be shown. Enter the verification code sent to you either by email or SMS depending on your Personal Area security type. Click Confirm.

4. On the next page you’ll need to select/provide some information, including:

a. Bank name

b. Bank account type

c. Bank account number

5. Click Confirm once the information is input.

6. A screen will confirm the withdrawal has been completed.

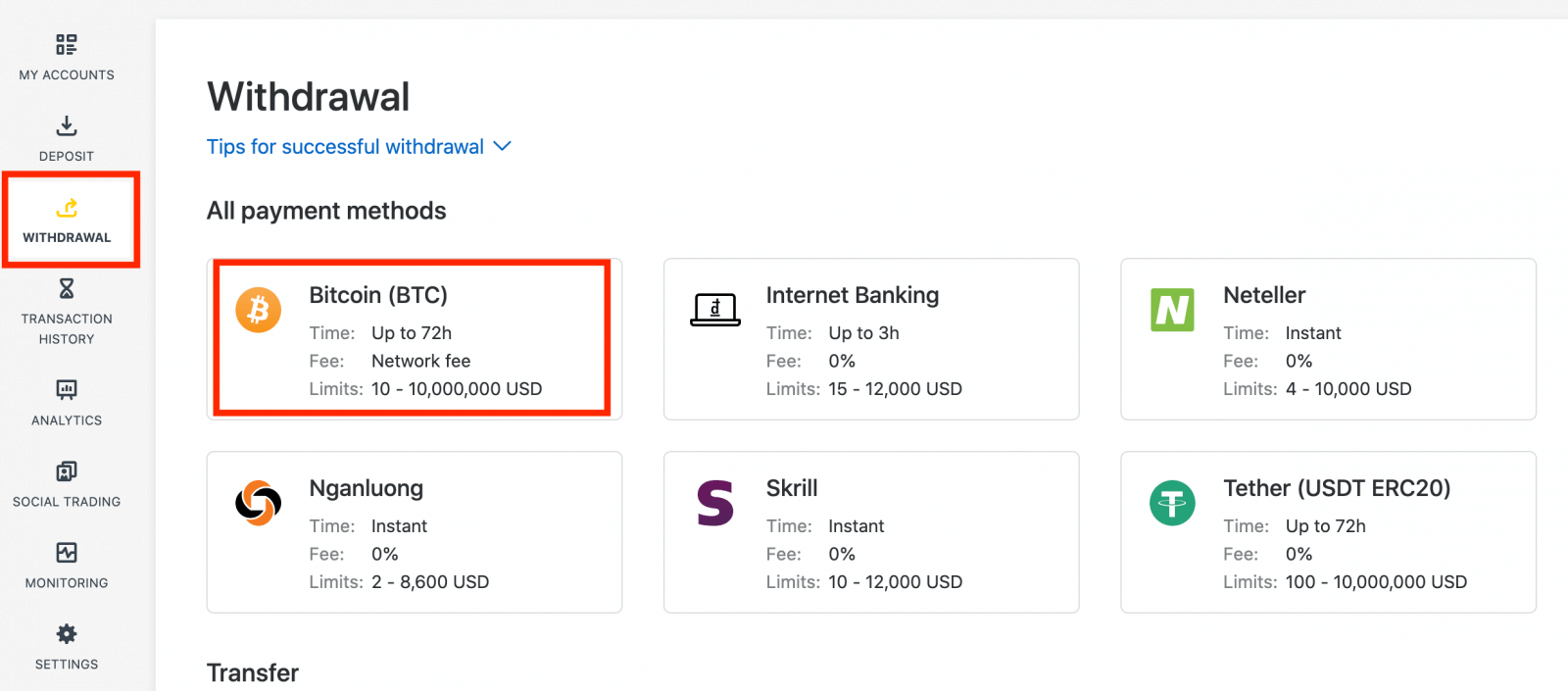

Cryptocurrencies

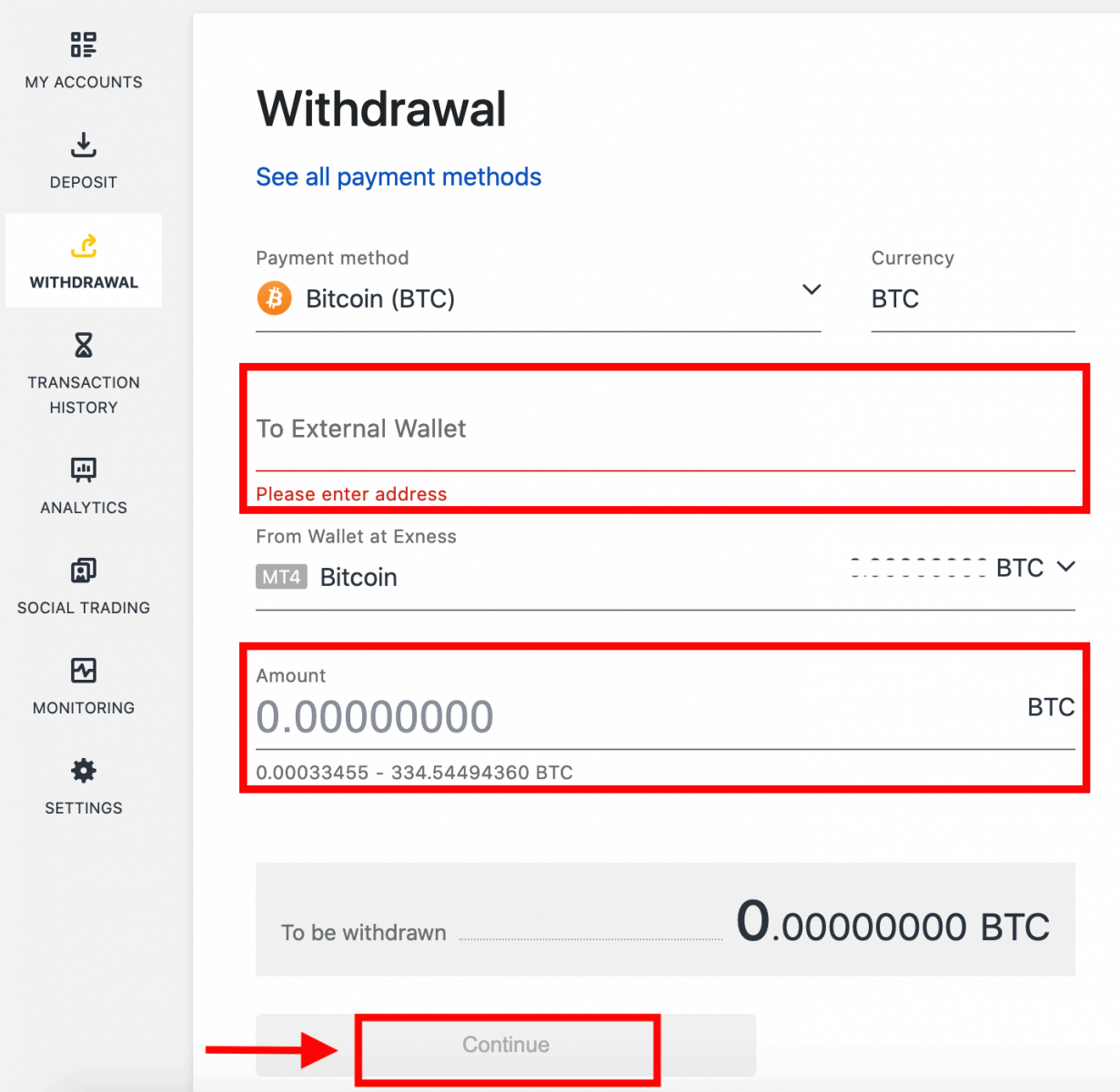

We accept withdrawals in cryptocurrencies to make your trading journey more efficient. For that reason, let us explain to you how you can do it.1. Go to the Withdrawal section in your Personal Area and click Bitcoin (BTC).

2. You will be asked to provide an external Bitcoin wallet address (this is your personal Bitcoin wallet). Find your external wallet address displayed in your personal Bitcoin wallet, and copy this address.

3. Enter the external wallet address, and the amount you wish to withdraw, then click Continue.

Take care to provide this exact or funds may be lost and irrecoverable and the withdrawal amount.

4. A confirmation screen will show all the details of your withdrawal, including any withdrawal fees; if you are satisfied, click Confirm.

5. A verification message will be sent to your Exness account’s security type; enter the verification code and then click Confirm.

6. One last confirmation message will notify you that the withdrawal is complete and being processed.

See two withdrawal transactions instead of one?

As you are already aware, withdrawal for Bitcoin works in the form of refunds (similar to bank card withdrawals). Therefore, when you withdraw an amount that is more than the non-refunded deposits, the system internally splits that transaction into a refund and a profit withdrawal. This is the reason you see two transactions instead of one.

For example, say you deposit 4 BTC and make a profit of 1 BTC from trading, giving you a total of 5 BTC in total. If you withdraw 5 BTC, you will see two transactions - one for an amount of 4 BTC (refund of your deposit) and another for 1 BTC (profit).

Frequently Asked Questions (FAQ)

Withdrawal fees

No fees are charged when withdrawing, but some payment systems may impose a transaction fee. It’s best to be aware of any fees for your payment system before deciding to use it for deposits.

Withdrawal processing time

The vast majority of withdrawals by Electronic Payment Systems (EPS) are performed instantly, understood to mean that the transaction is reviewed within a few seconds (up to a maximum of 24 hours) without manual processing. Processing times can vary based on the method used, with the average processing typically the length of time to expect, but it is possible to take the maximum length shown below this (Up to x hours/days, for example).If the stated withdrawal time is exceeded, please contact the Exness Support Team so we can help you troubleshoot.

Payment System Priority

To ensure your transactions reflect in a timely manner, do note the payment system priority put in place to provide efficient service and comply with financial regulations. This means that withdrawals through the listed payment methods should be done in this priority:

- Bank card refund

- Bitcoin refund

- Profit withdrawals, adhering to the deposit and withdrawal ratios explained previously.

Grace period and withdrawals

Within the grace period, there is no limitation on how much funds can be withdrawn or transferred. However withdrawals cannot be made using these payment methods:- Bank Cards

- Crypto Wallets

- Perfect Money

What should I do if the payment system used for the deposit is not available during the withdrawal?

If the payment system used for deposit is not available during withdrawal, please contact our Support Team via chat, email, or call, for an alternative. We will be happy to help you out.Note that while this is not an ideal situation, at times we may need to switch off certain payment systems due to maintenance issues on the provider’s end. We regret any inconvenience caused and are always ready to support you.

Why do I get an “insufficient funds” error when I withdraw my money?

There may not be enough available funds in the trading account to complete the withdrawal request.Please confirm the following:

- There are no open positions on the trading account.

- The trading account selected for the withdrawal is the correct one.

- There are enough funds for withdrawal in the chosen trading account.

- The conversion rate of the currency selected is causing an insufficient amount of funds to be requested.

For further assistance

If you have confirmed these and still get an “insufficient funds” error, please contact our Exness Support Team with these details to be assisted:

- The trading account number.

- The name of the payment system you are using.

- A screenshot or photo of the error message you are receiving (if any).

Conclusion: Seamlessly Sign In and Withdraw Funds from Exness

Logging in and withdrawing money from Exness are essential processes for managing your trading account efficiently. By following this guide, you can smoothly access your account and handle your withdrawal requests with confidence. Whether you are accessing your funds or managing your trading activities, Exness provides a user-friendly platform to meet your needs. Ensure you follow these steps to facilitate a smooth and efficient transaction process, supporting your overall trading success.