Deposit and Withdrawal on Exness using SCB Bank Mobile Banking

Exness is a renowned trading platform that provides users with a wide array of financial instruments for trading, including forex, stocks, and cryptocurrencies. One of the key aspects of a seamless trading experience is the ability to easily deposit and withdraw funds.

For traders in Thailand, SCB (Siam Commercial Bank) Mobile Banking offers a convenient way to manage your transactions on Exness.

This guide will walk you through the process of depositing and withdrawing funds from Exness using SCB Bank Mobile Banking, ensuring smooth and efficient transactions.

For traders in Thailand, SCB (Siam Commercial Bank) Mobile Banking offers a convenient way to manage your transactions on Exness.

This guide will walk you through the process of depositing and withdrawing funds from Exness using SCB Bank Mobile Banking, ensuring smooth and efficient transactions.

SCB Bank Mobile Banking

You can now top up your trading account in Thai baht with SCB Bank Mobile Banking, a payment method that allows you to transfer funds to your Exness account from the payment wallet linked to your mobile banking application.As opposed to payments in USD or any other currency, depositing and withdrawing using your local currency means you don’t need to worry about currency conversion. Additionally, there is no commission when funding your Exness account with SCB Bank Mobile Banking.

Here’s what you need to know about using SCB Bank Mobile Banking:

| Thailand | |

| Minimum deposit | USD 10 |

| Maximum deposit | USD 58 000 |

| Minimum withdrawal (with online bank payment) |

USD 1 |

| Maximum withdrawal (with online bank payment) |

USD 10 000 |

| Deposit processing fees | Free |

| Withdrawal processing fees | Free |

| Deposit processing time | Instant (Up to 4 hours) |

| Withdrawal processing time | Instant (Up to 24 hours) |

Note: The limits specified above are per transaction unless mentioned otherwise.

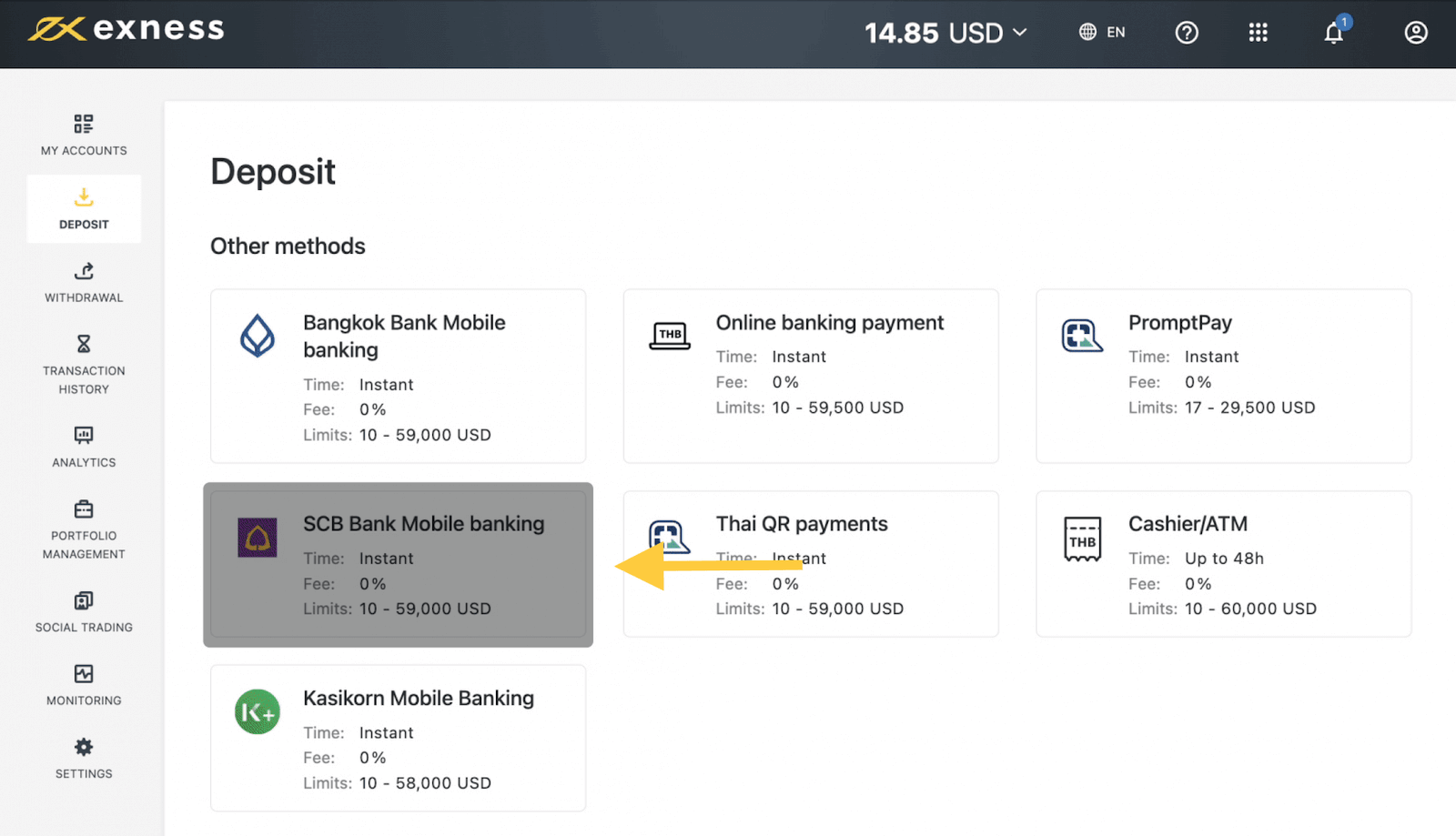

Deposits with SCB Bank Mobile Banking

To top up your trading account using SCB Bank Mobile Banking:1. Go to the Deposit section in your Personal Area, and click SCB Bank Mobile Banking.

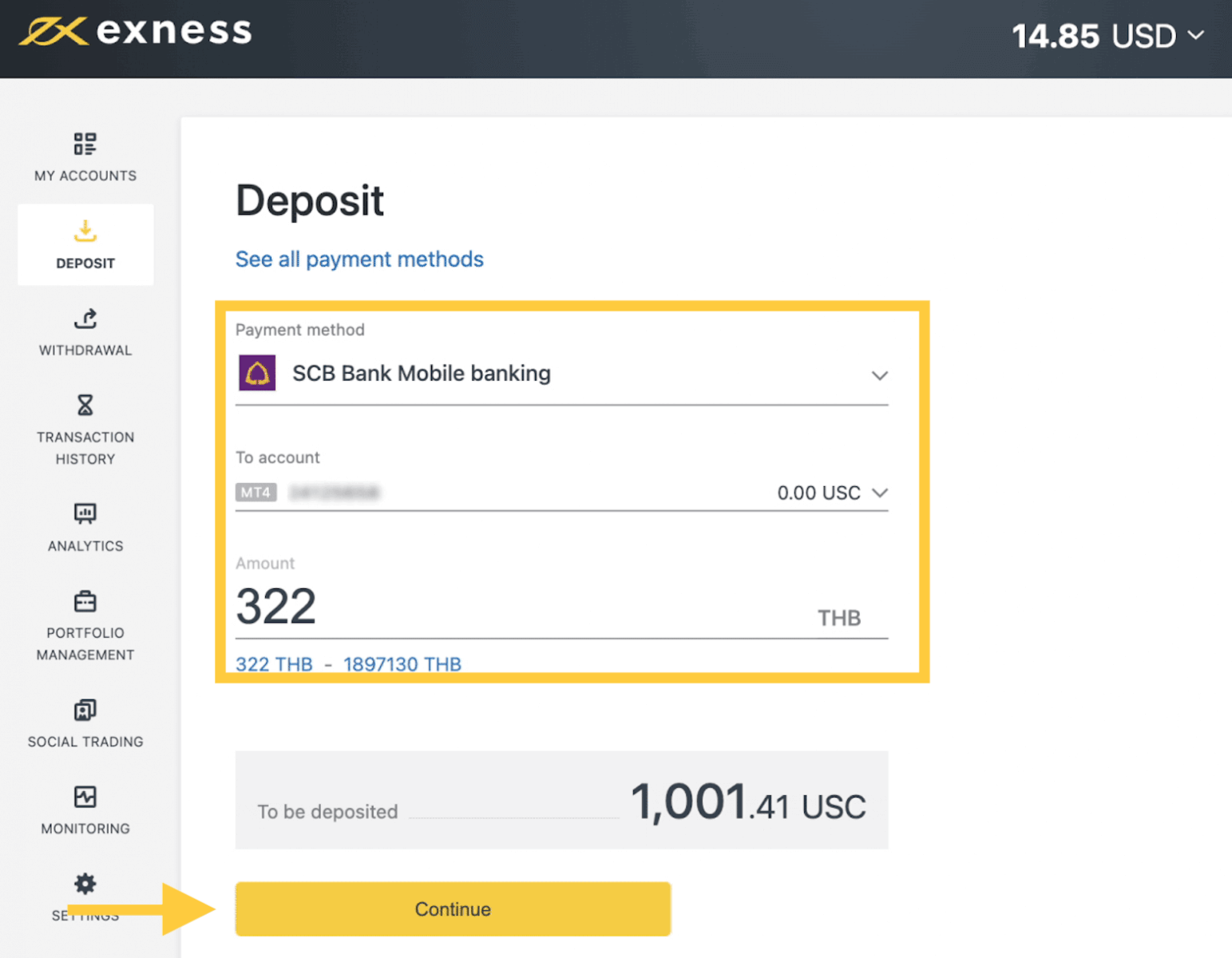

2. Select the trading account you would like to top up, enter the deposit amount, and click Continue.

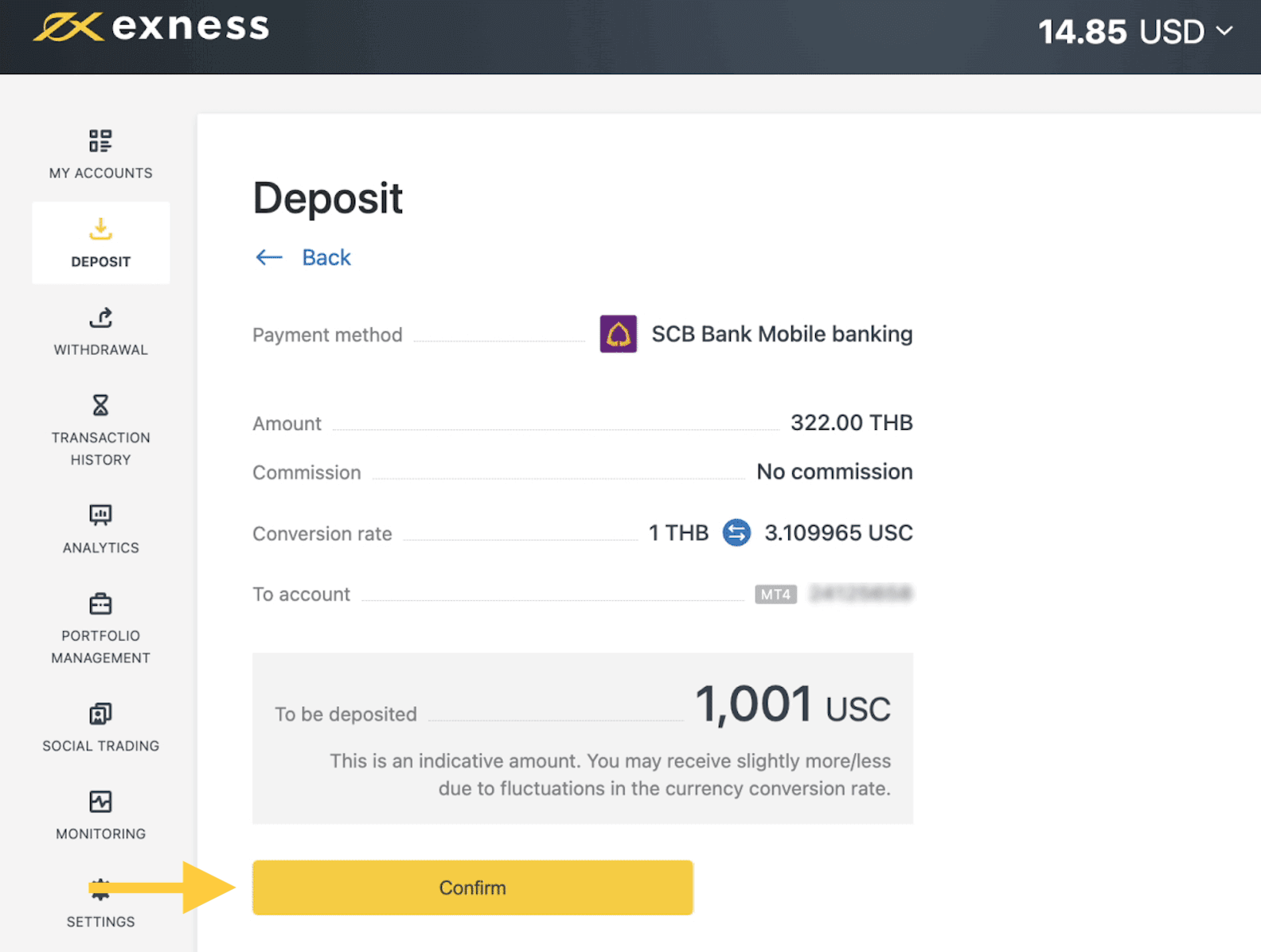

3. You will be shown a summary of the transaction. Click Confirm.

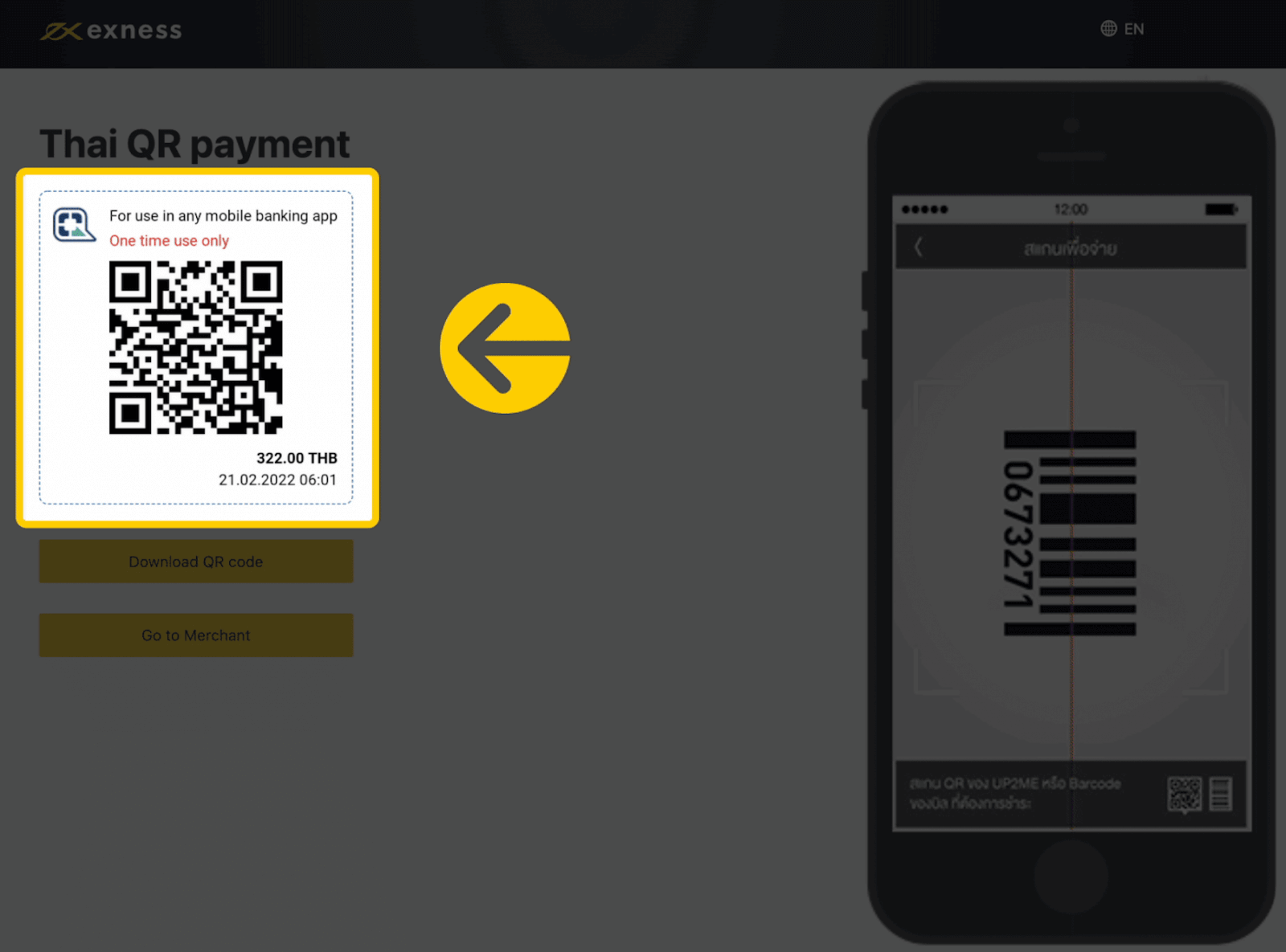

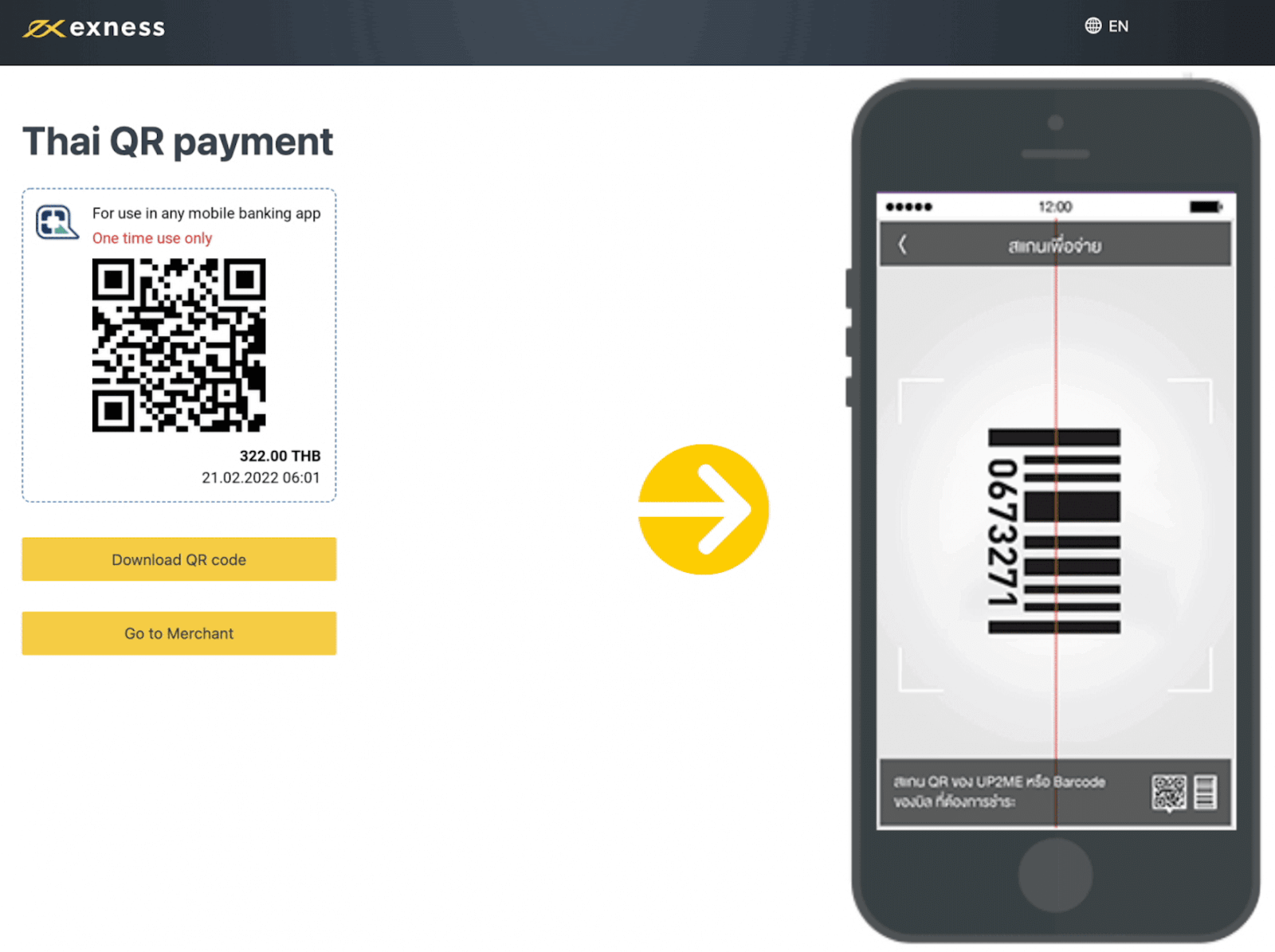

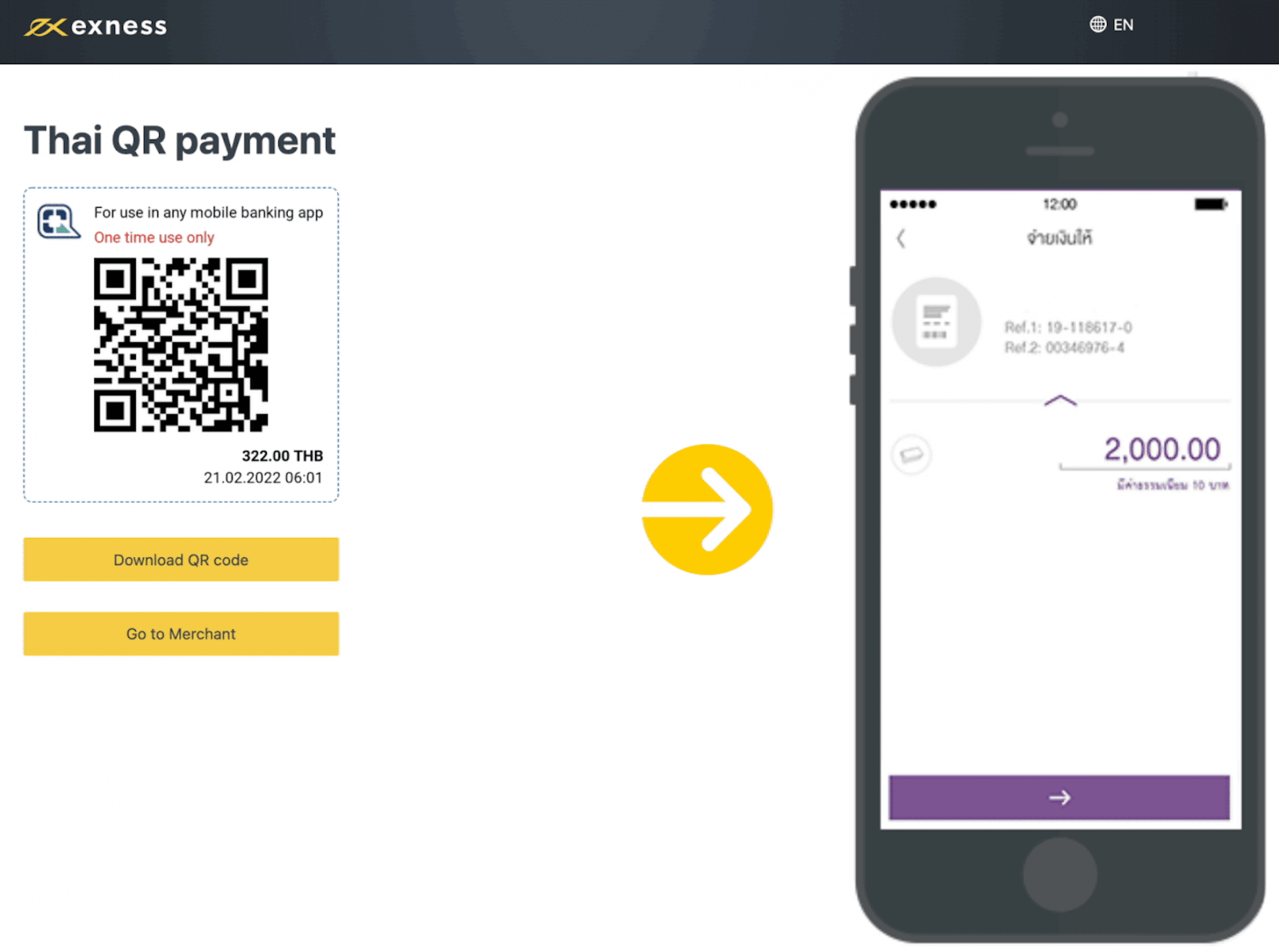

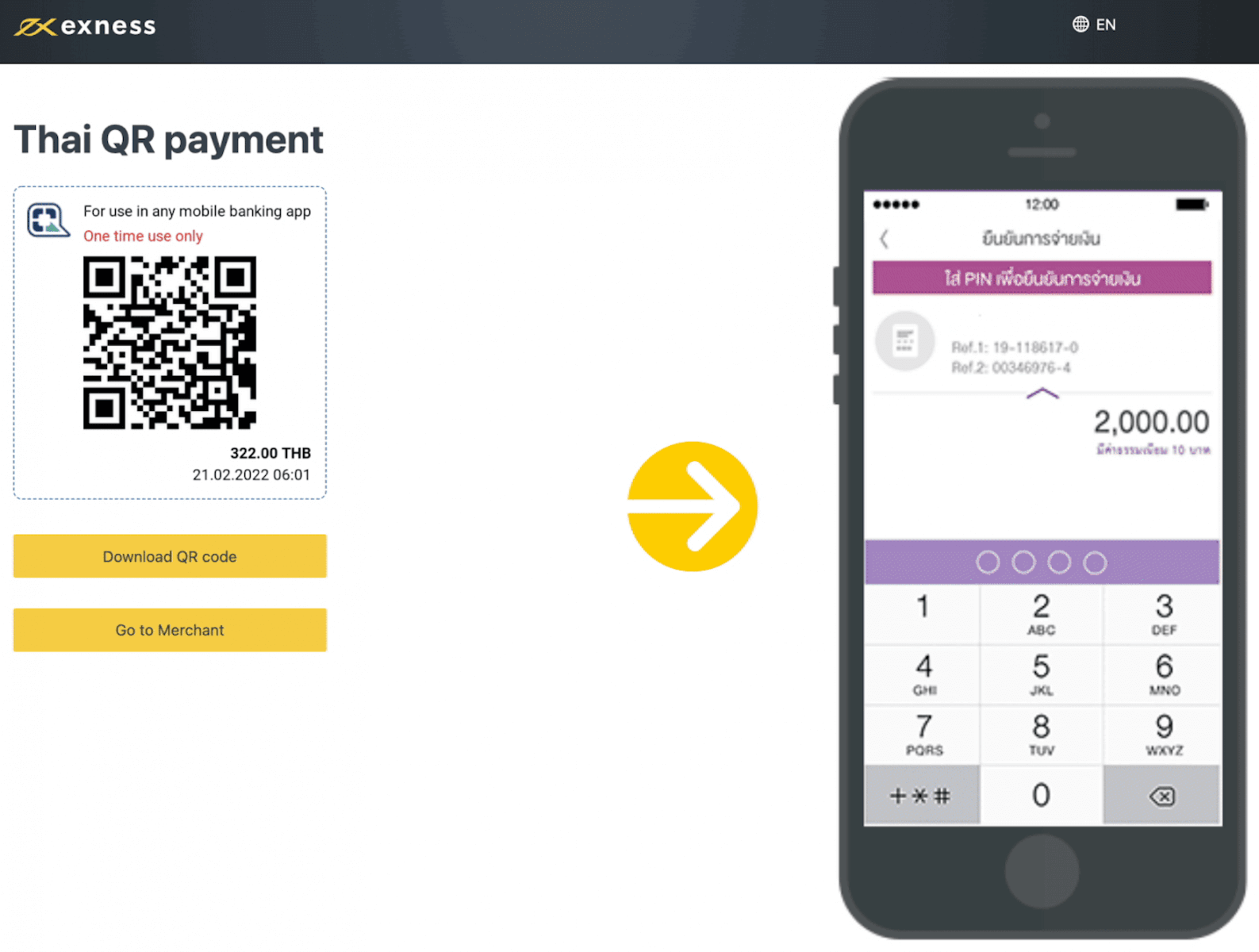

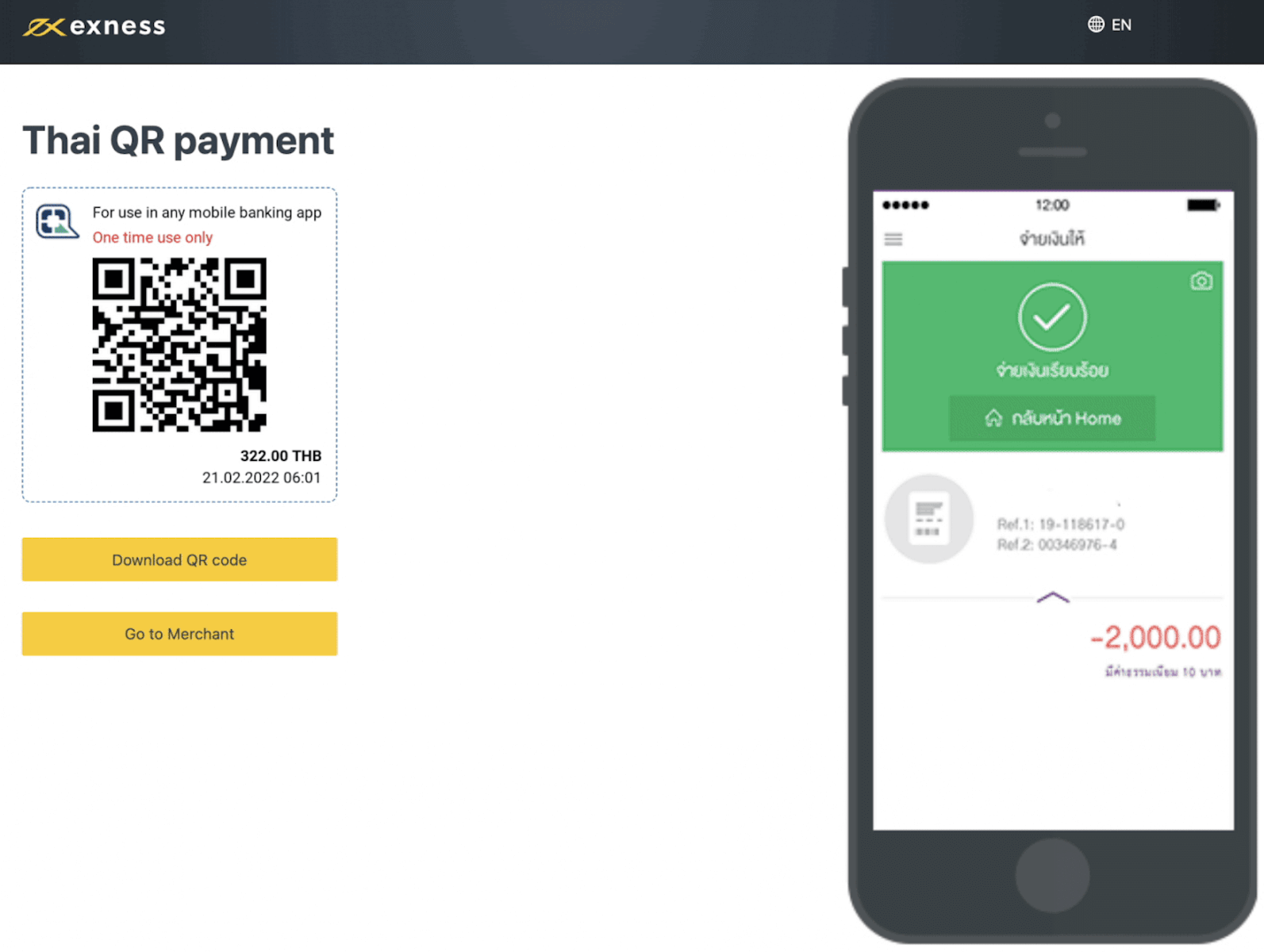

4. You will receive a QR code.

5. Go to the SCB Mobile application on your phone and select Pay Bills.

6. Under the To tab tap on Scan bills. Check the transaction details and scan the QR code.

7. Input the verification code sent by the bank to confirm the transaction.

You’ll receive the funds in your trading account within 4 hours.

Withdrawals with online banking payment in Thailand

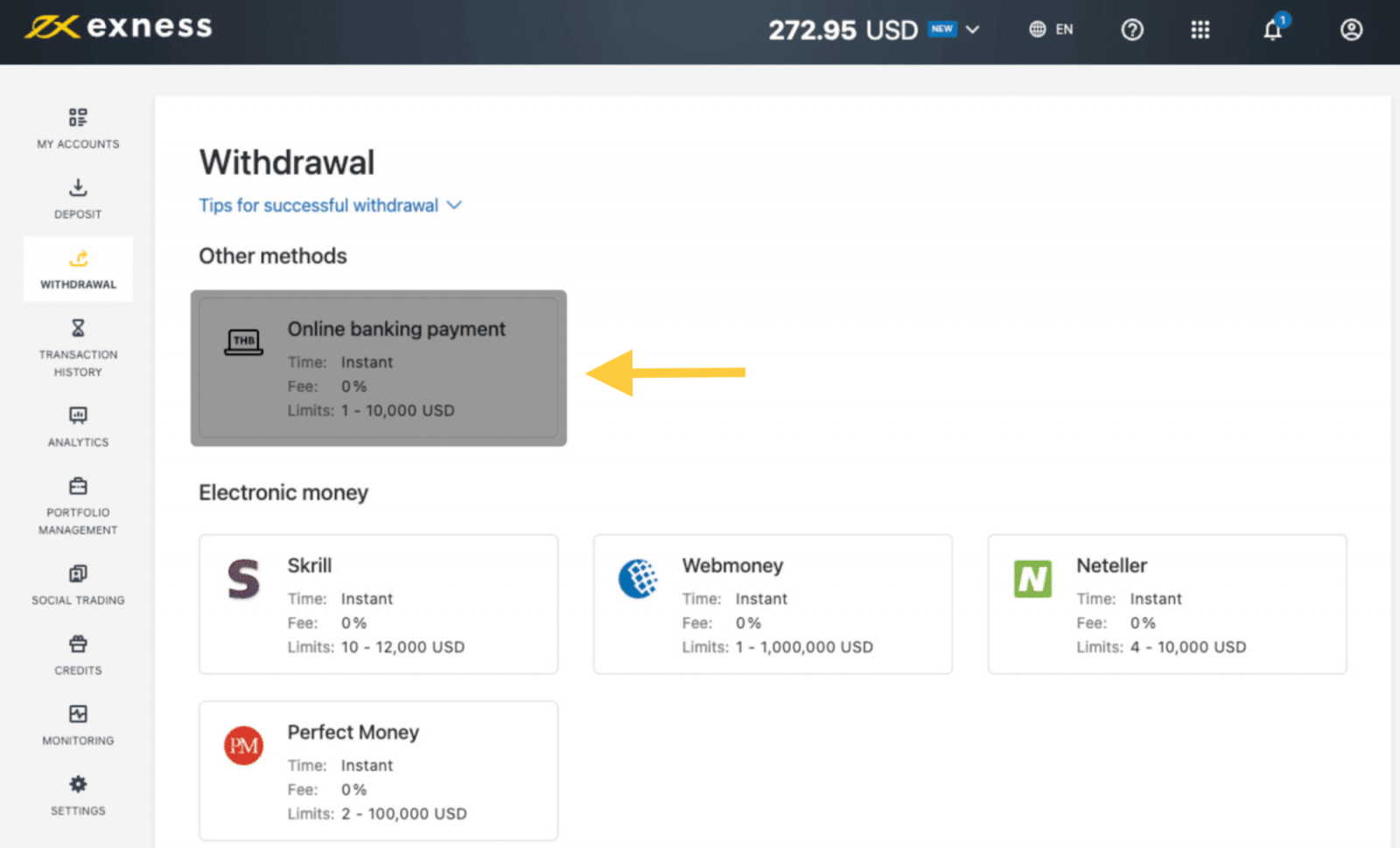

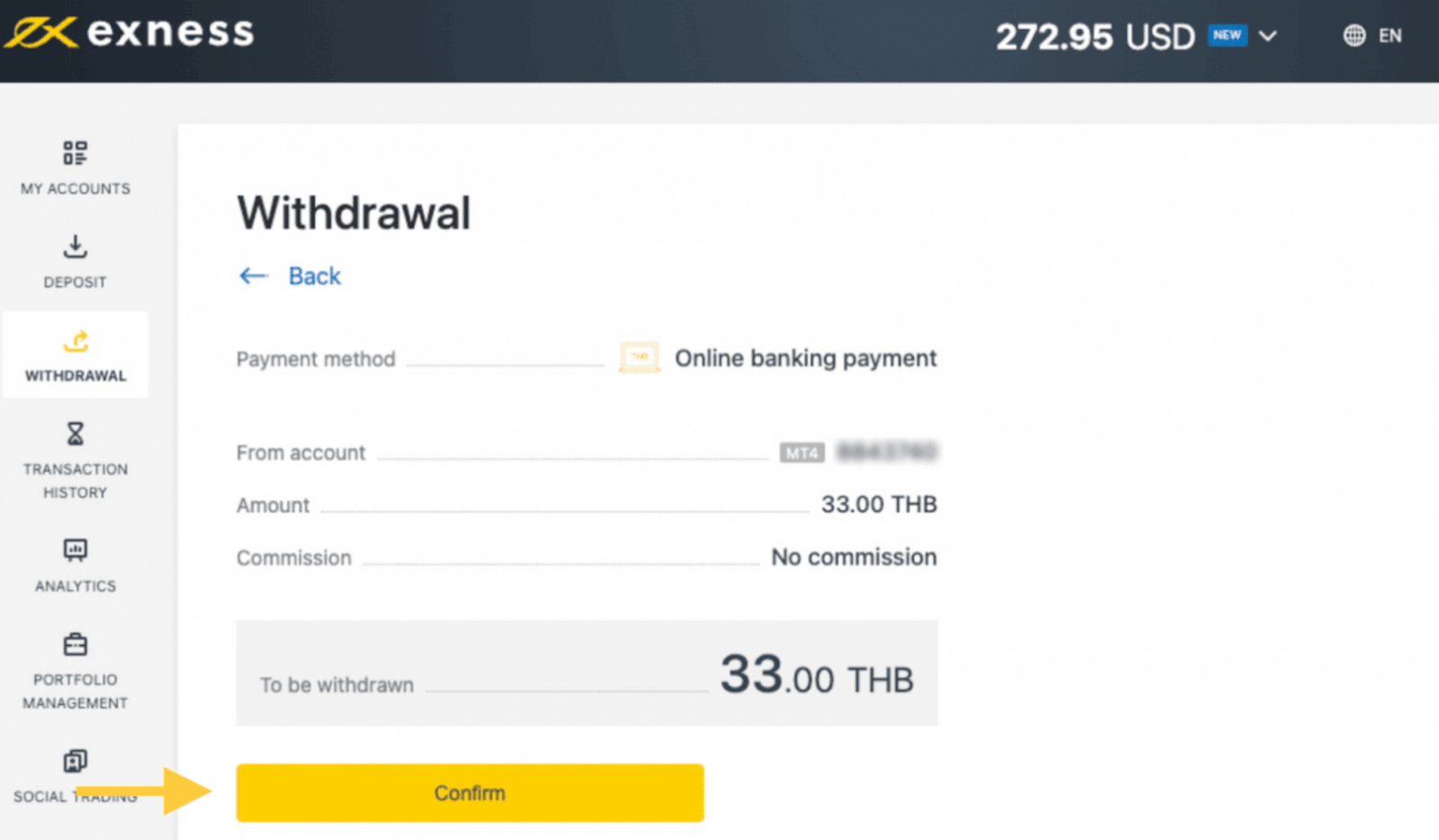

To withdraw funds from your trading account:1. Click Online banking payment in Thailand in the Withdrawal section of your Personal Area.

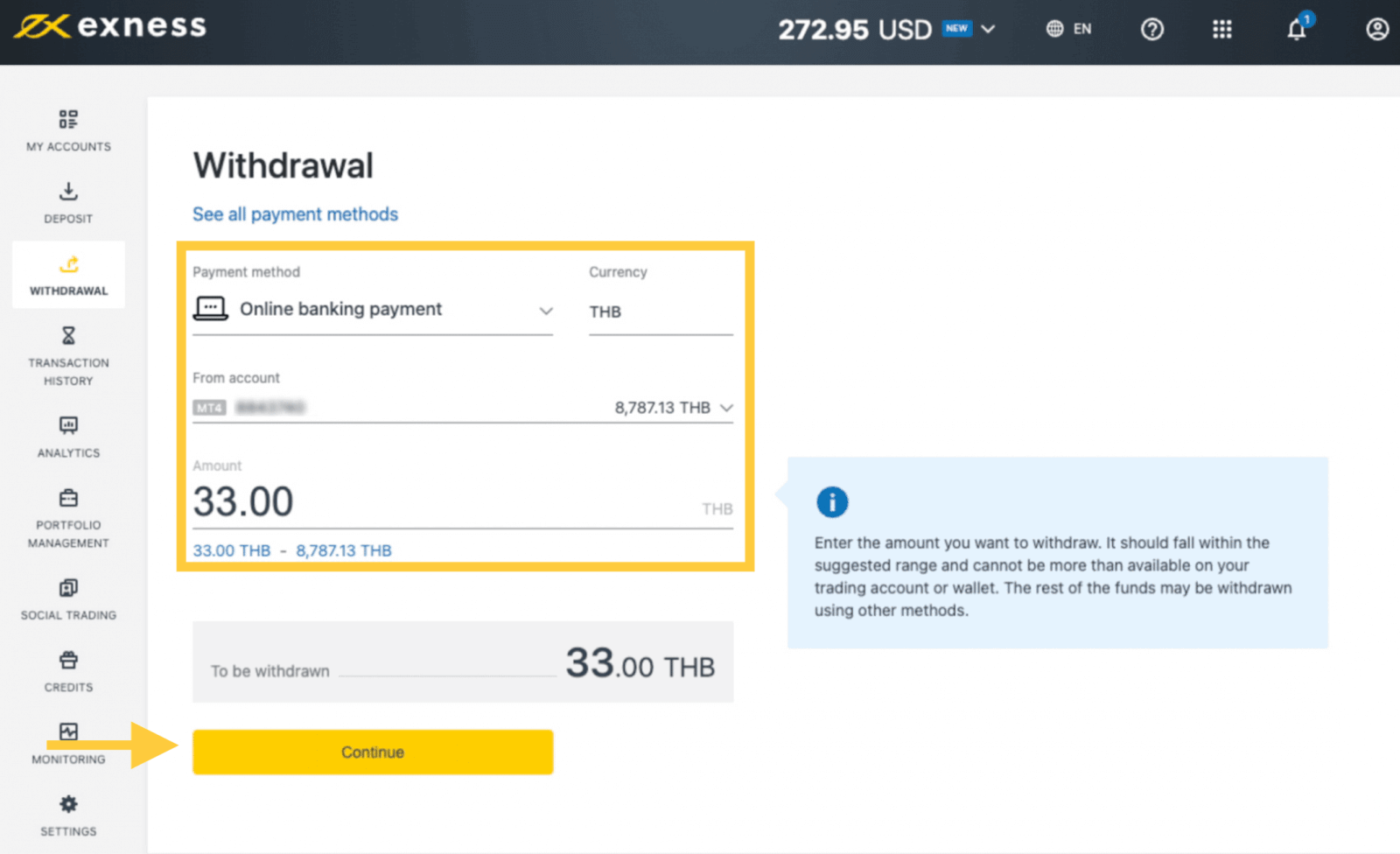

2. Select the trading account you would like to withdraw funds from, choose your withdrawal currency and enter the withdrawal amount in your account currency. Click Continue.

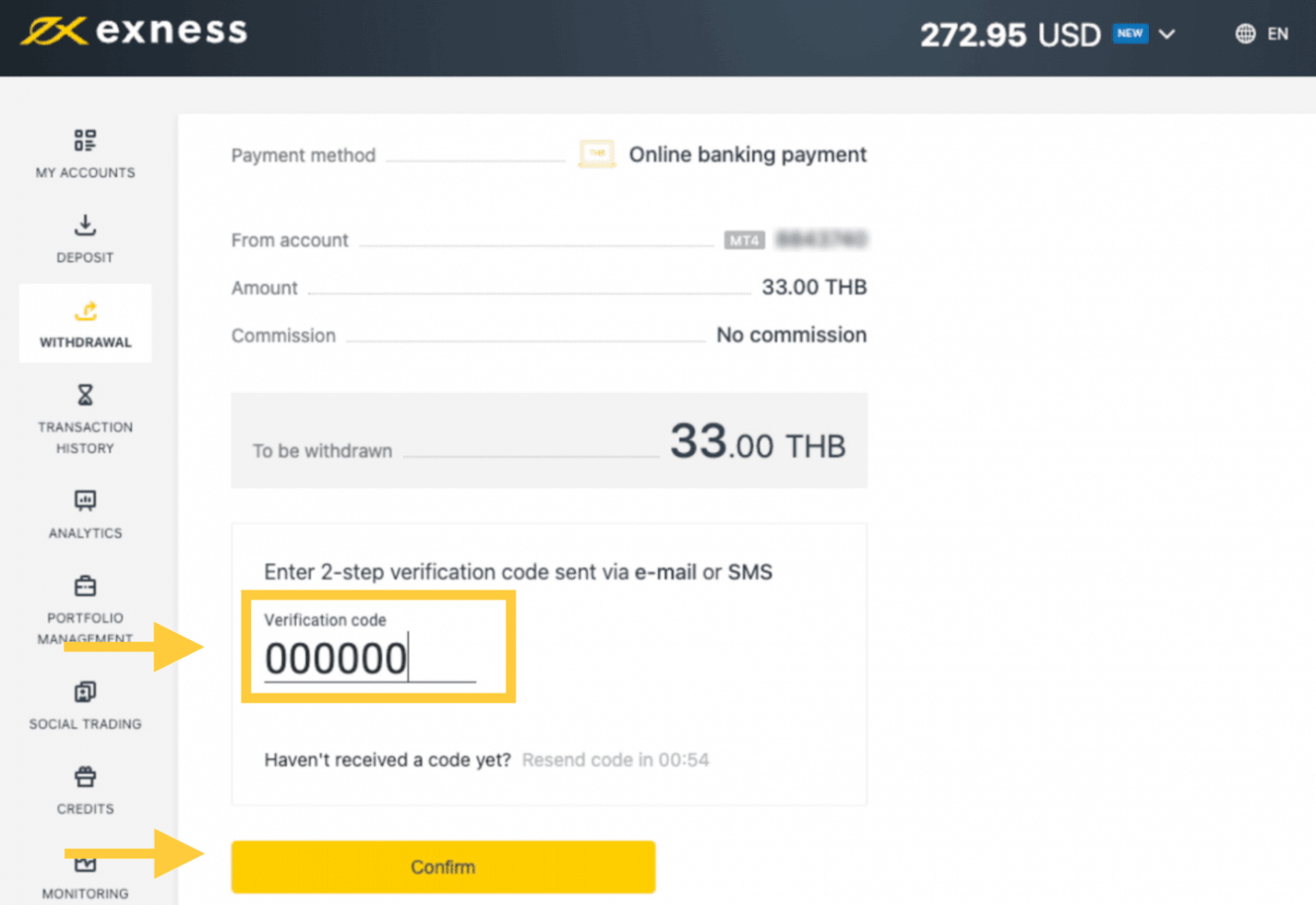

3. A summary of the transaction will be shown. Enter the verification code sent to you either by email or SMS depending on your Personal Area security type. Click Confirm.

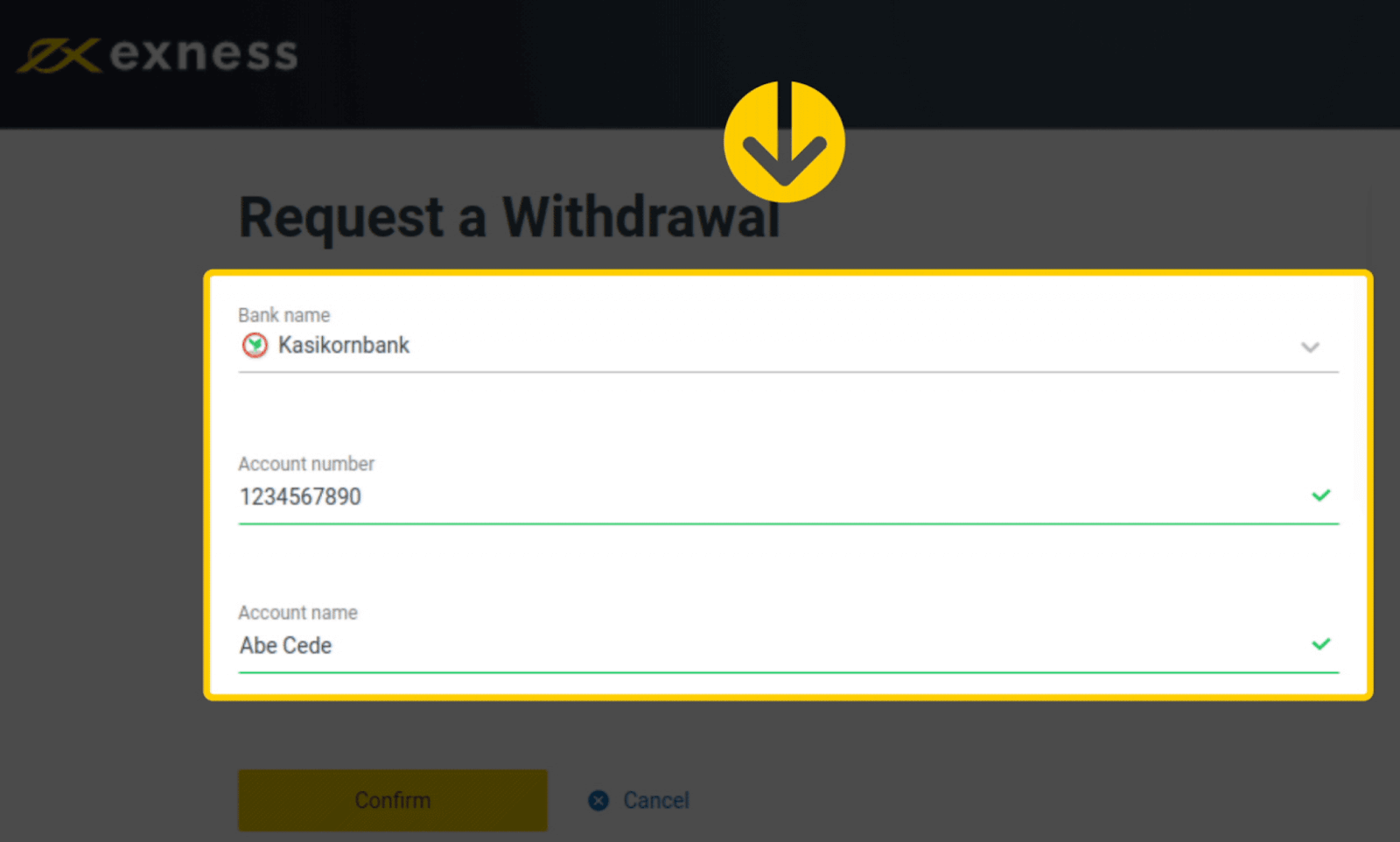

4. You will be redirected to a page where you will need to select SCB Bank from the drop down, fill in your account number, account name, and follow the prompts to complete the transaction.

Your withdrawal should be credited to your bank account within 24 hours.