What is Exness Social Trading? How to Use It

What is Exness Social Trading?

Social Trading makes it simple as novice traders can copy experienced traders with both earning from profitable trades. Along with an impressive suite of tools, control over your investments is firmly in the palm of your hand.

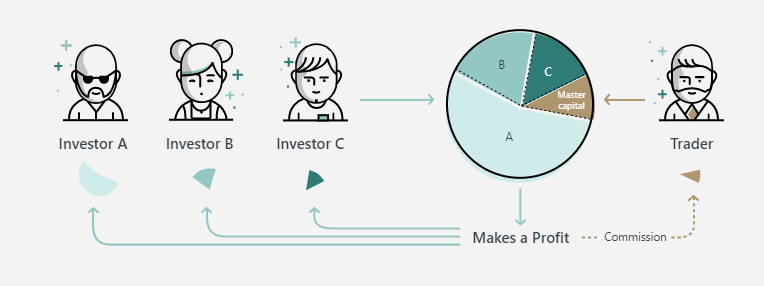

The Investor

An investor is a copy trader that uses the Social Trading service to browse and choose trading strategies created by experienced traders (we refer to as a strategy provider), subsequently copying the trades made in these strategies.

The Strategy Provider

The goal of a strategy provider is to profit off their trades, and as they do investors also earn (at proportional rates). The strategy as a whole is measured by metrics for calculating Return and risk, the former being a signal of performance while the latter a dynamic risk range that updates constantly.

When a strategy provider’s strategy makes a profit, they also earn commission at a rate they set (between 0%-50%). This is obtained at the end of a trading period.

How does It work?

As Strategy Provider (Trader)

Let’s discuss you as a strategy provider and explain how does it actually work. If you have any good we actually mean the best trading strategies that you want to share with others and can earn an additional amount of profit then exness social trading is right for you. Just open a Social trading account and share your trading strategies.

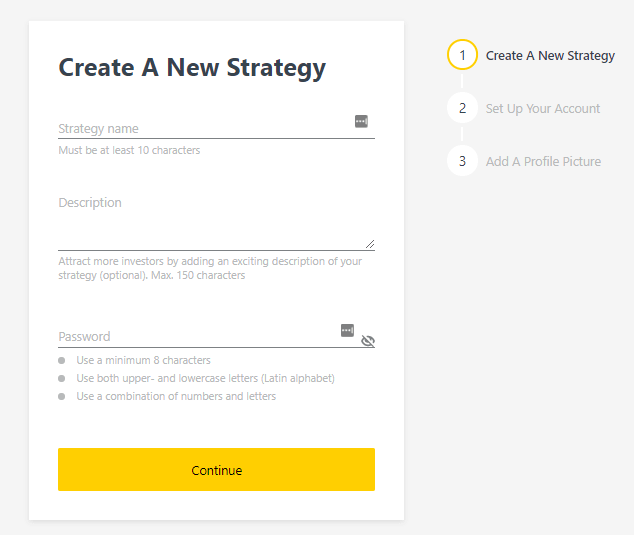

Singin to your Exness Cabinet and then find the “Social Trading” Section. From here you can check there is a form where you can register your trading strategies with exness communities.

Give a name to your strategies along with some descriptions and set a password and then click the “Continue” button. Here a new page comes where you need to declare your preferable profit ratio and account currency.

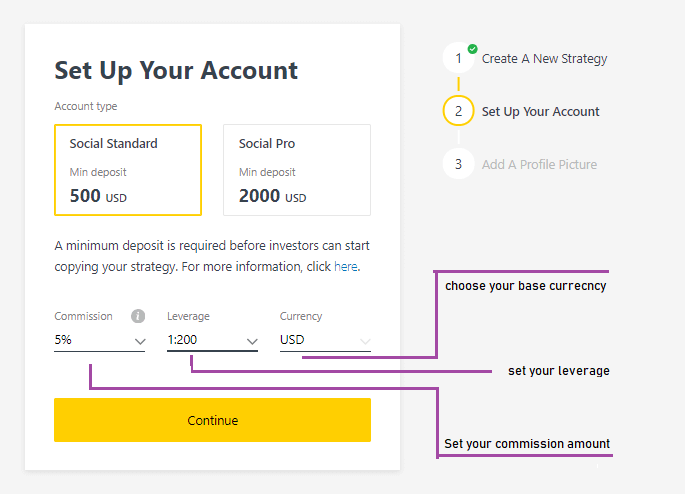

first of all, you need to decide what will be your profit sharing ratio. It starts with 0% to 50% at maximum. Based on this ratio, your return will be calculated. Confused??

For example, if you set aside 5% in commission and someone (Investor) starts coping with trade and the questing is, how the investor pay you for any profitable entry? Simple, as you have charged a commission which means you are charging the investor for a profit share. So, if an investor gains a profit of $100 in total which means, you will be paid 5% of. As a result, it will be $5 in total. So, you should decide what amount you want as profit sharing from your investors.

And lastly, choose a profile picture for your trading strategies and click upload. You have successfully registered a social trading account as a Strategy Provider. A confirmation email has been sent to your registered email address with your social trading account number and everything. Now you can start trading on your own and others can join or copy your trading systems where you can earn some extra amount of cash as a reward to be a good Trader.

As a Strategy Follower (Investor)

Let’s discuss you as a strategy follower and explain how does it actually work. We hope, you understand the details of Strategies Provider. In simple words, strategy followers are the opposite person of traders who acts as an investor.

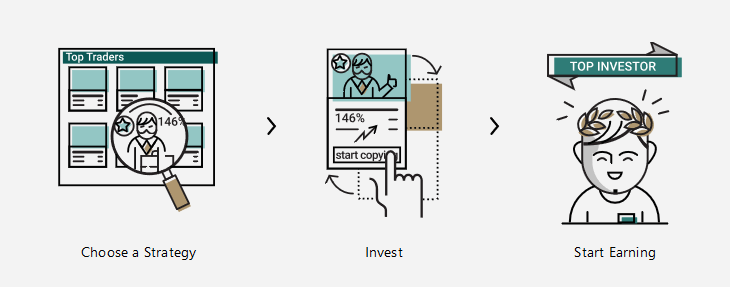

In these cases, you need to find out the best possible trading strategies and copy their trade automatically. Thing is you need to download the Exness Social Trading App and create an account. Apps are available for both android and ios system. You can start copying in just three single steps.

it’s too simple to use. choose your preferred trading strategies and deposit via your preferred deposit system. Trade will execute automatically when your traders make or close any entry of their own. You do not need to do anything except deposit or withdraw funds from your social trading account.

How does Copying work?

Copying is a process through which strategy provider’s trades are copied to the investor’s account, after factoring in a copying coefficient.

Let us look at two scenarios an investor may encounter:

An investor can start copying a strategy even when the market is closed (up to 3 hours before the market reopens). In such cases, the orders will be copied at the last available market price.

-

Start copying without open trades:

Investor chooses to invest in a strategy which doesn’t have any open trades at the moment. Once he clicks on ‘Open a new investment’, the system calculates a copying coefficient. When the strategy provider opens a trade, the trade is immediately copied to investor’s account at the same opening price.

If the strategy provider opens a trade of 1 lot, and the calculated copying coefficient is 2, the trade will be copied as 2 lots on the investment account.

-

Start copying with open trades:

Investor chooses to invest in a strategy which currently has some open trades. Once he clicks on ‘Open a new investment’, the system calculates a copying coefficient. In this case the copying coefficient is calculated differently because it also involves the strategy provider’s open trades’ spread cost.

Trades already open are copied onto the investor’s account using the current market price which may be different from the opening price of the trades on the strategy provider’s side.

If the strategy provider opens a trade of 1 lot, and the calculated copying coefficient is 2, the trade will be copied as 2 lots on the investment account at current market price.

-

Subsequent copying:

When the strategy provider opens new trades, they will be immediately copied onto the investor’s account using the same opening price as that of the strategy provider. The copying coefficient used for calculation is the actual copying coefficient which is calculated and updated according to these rules.

If the strategy provider opens a trade of 1 lot, and the calculated copying coefficient is 2, the trade will be copied as 2 lots on the investment account at the same price as that on the strategy provider’s side.

What is Social Trading Commission?

Social Trading commission is a fee that an investor pays to a strategy provider for profitable investments. With Social Trading, strategy providers pre-define a commission rate at which investors are to share their profits for the copied strategies.

For example:

If an investor makes a profit of USD 1 000 on an investment and the commission rate is 10%, he will be charged USD 100 to be paid as commission to the strategy provider.

Social Trading commission is credited to a Standard trading account automatically created in the strategy provider’s Personal Area for this purpose. It is called the Social Trading Commission account and these funds once credited can be used for trading, withdrawals, or for transferring to other accounts.

Benefits of Exness Social Trading

- No trading on your own. And you may have the opportunity to copy the good and skilled traders’ accounts.

- Since there is no need to trade on your own, there is no need to pay time for trading and there is no need to keep up with the various market news and updates.

- Trade can also be started by providing a minimum balance. It means it does not require a large investment by itself. You can also deposit funds according to your ability.

- There is a privilege to select the trader as per your choice and you can determine the lot size, profit/loss ratio as per your own.

- If you want then you can copy multiple trader’s trades in the same account.

- Funds can be transacted immediately.

We hope you understand all the issues related to Exness Social Trading. Those who wish to take advantage of such trading must analyze the copy traders’ account and its strategies and overall risk ratio first. However, if you have any further questions, please let us know by email or phone or post your comment below. We will try our best to assist you further.